Microsoft (MSFT) Stock Analysis – July 18, 2025

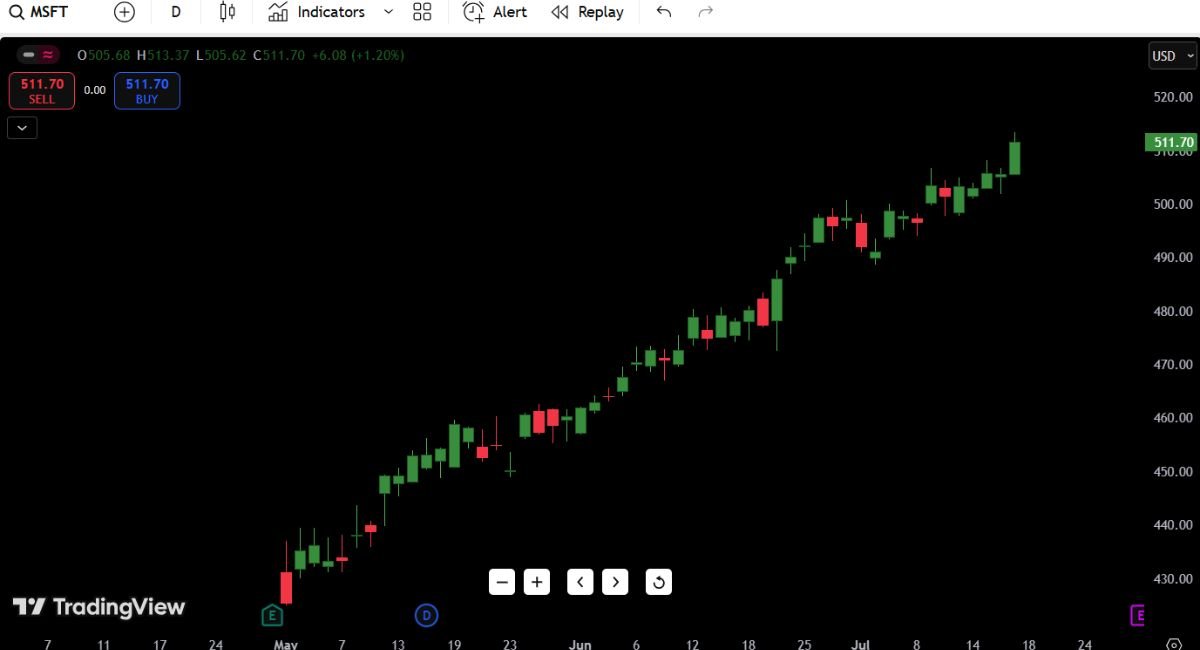

Microsoft (MSFT) stock price today is $511.70, up +1.20% on the day. The daily candle just closed green, clean, and full-bodied—buyers are clearly in control.

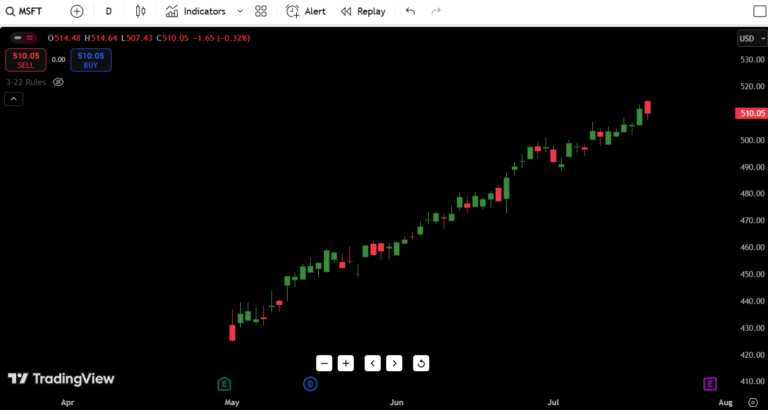

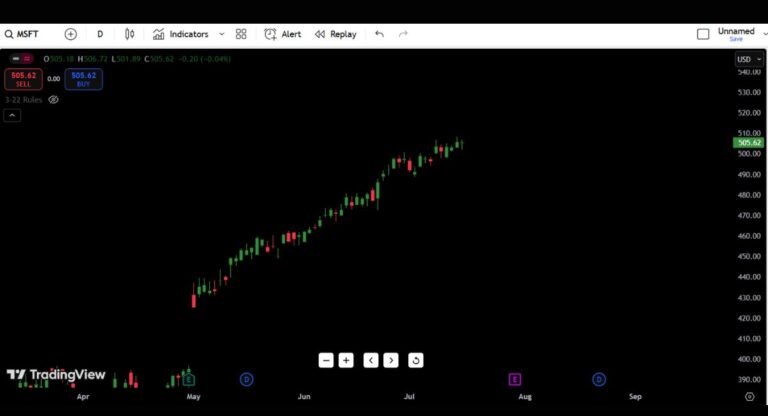

- Trend: Strong, extended uptrend (3-month run)

- 52-Week Range: $312.10 – $513.37 (today’s high)

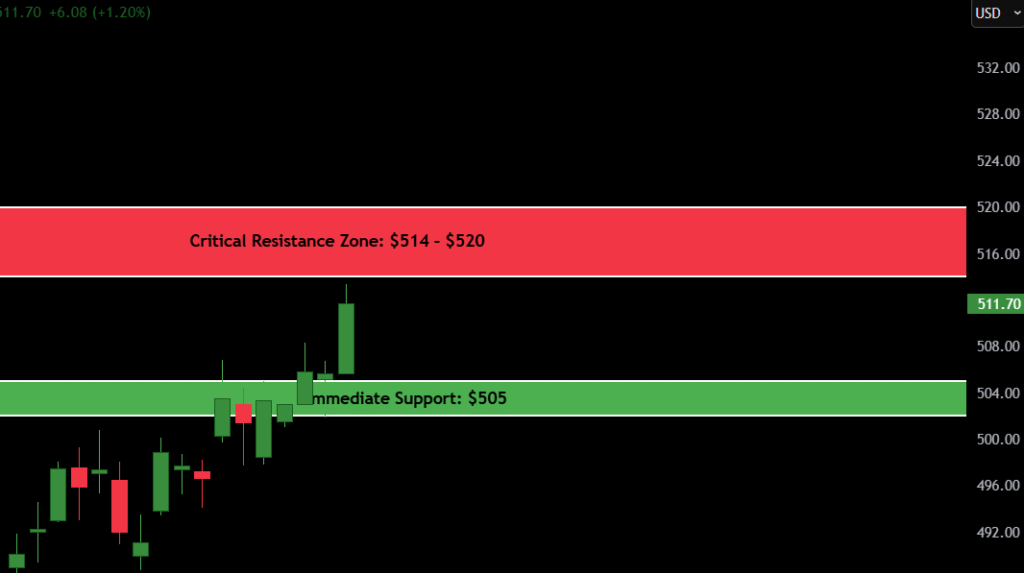

- Critical Resistance Zone: $514 – $520

- Immediate Support: $505 – recent breakout base

- Watch for: Retest of breakout zone or fakeout over 52W high

Also Read: Microsoft corporation bullish and bearish analyst opinions

Contents

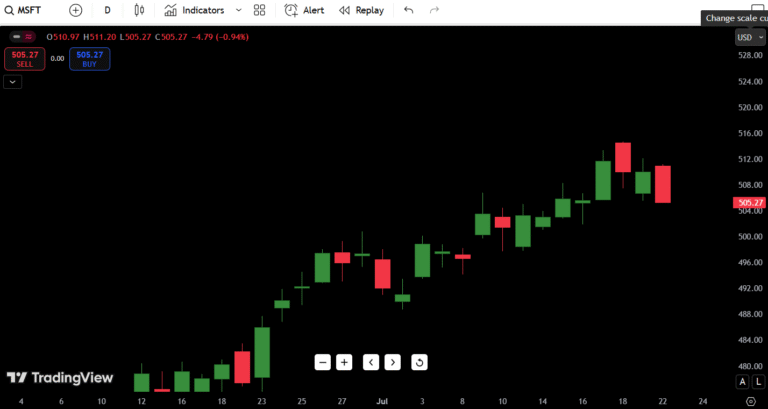

MSFT Candlestick Chart Analysis

Alright, let’s talk price action like we’re reading the tape:

Trend Structure – Clean Uptrend

- Since late April, MSFT has barely taken a breath.

- We’re seeing higher highs, higher lows, and orderly pullbacks.

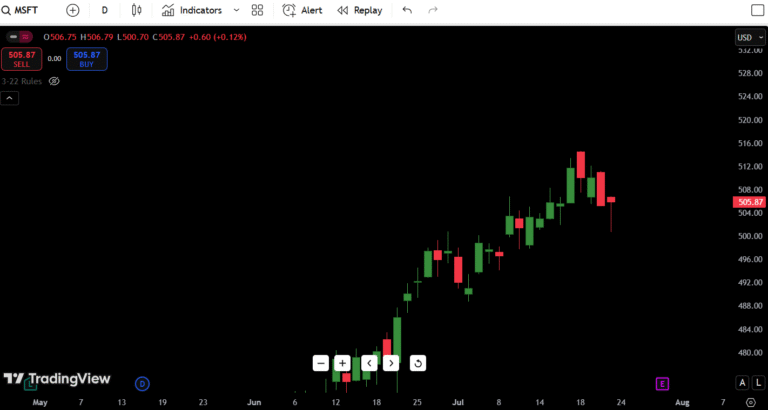

- The 3-week consolidation from late June to mid-July built up energy—and now boom, we’ve got a breakout candle.

Today’s Candle – Breakout, Not a Fakeout

- Open: $505.68

- Close: $511.70

- High: $513.37

That’s a power candle, no top wick means bulls held it into the close—not profit-taking, not hesitant buying. This is conviction.

It’s the kind of candle that usually attracts trend-following algos and late FOMO traders. Volume wasn’t visible, but based on price movement, it’s likely strong.

Key Chart Signals

- Breakout above range: The $505 zone was a resistance shelf—MSFT has now closed cleanly above it

- No bearish divergence signs: Without RSI/MACD on screen, we look at price action — and it’s bullish, not exhausted.

- No doji, no reversal candles: Just clean follow-through.

If this were a fakeout, we’d expect upper wick rejection. We didn’t get it.

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $514 | 52-week high – breakout test zone |

| Resistance 2 | $520 | Round number + psychological barrier |

| Resistance 3 | $528 | Fibonacci 1.272 extension target |

| Resistance 4 | $545 | Projected measured move |

| Support 1 | $505 | Breakout base – must hold zone |

| Support 2 | $492 | Last demand candle |

| Support 3 | $478 | Range low from June consolidation |

| Support 4 | $460 | Volume shelf + 20EMA zone |

$505 is critical. If MSFT re-tests this zone and buyers step in again, we could see $520+ quickly. If $505 fails, look to $492 as a catch.

7-Day Price Forecast for MSFT

| Date | High | Low | Expected Close |

|---|---|---|---|

| Jul 18 | $514 | $505 | $511.70 |

| Jul 19 | $518 | $507 | $515 |

| Jul 20 | $521 | $510 | $519 |

| Jul 21 | $526 | $512 | $524 |

| Jul 22 | $530 | $515 | $528.50 |

| Jul 23 | $537 | $518 | $534 |

| Jul 24 | $542 | $520 | $538 |

Based on trend strength and structure, here’s our near-term outlook:

Thesis: As long as $505 holds, the stock has fuel to grind toward the $530–540 range.

Buy, Hold, or Sell Recommendation

| Action | Condition | Reason |

|---|---|---|

| BUY | Closes above $514 resistance | Breakout + volume + trend intact |

| HOLD | Between $505–$514 | Watching for retest or momentum |

| SELL | Breaks below $492 | Failed breakout, loss of structure |

Why I’m Bullish:

We’ve got:

- A clean breakout candle

- 3 weeks of consolidation just resolved higher

- No topping structure, no reversal pattern

I’d personally look to buy dips into $507–$509, with stop just below $504. This keeps your risk tight, but gives room for a $520–$530 reward zone. Classic 2:1 or better risk-reward setup.

Not chasing. But I’m not fading this trend either. This is strength.

Fundamental Catalysts to Watch

- Earnings Report: July 30th — Big potential volatility mover

- AI Hype: MSFT’s investment in OpenAI and Azure’s AI infrastructure is not priced out yet

- Analyst Upgrades: JPMorgan just raised target to $540 — Street is bullish

- Macro Catalysts: Fed speak + CPI could inject volatility into tech

Overall: Fundamentals support this trend continuation. Unless we get a shock CPI/Fed hawkish twist, MSFT should hold strong.

Final Thoughts – My Personal Take

As someone who’s traded through fakeouts, double tops, and bull traps, I know how deceptive breakout candles can be. But this isn’t one of those.

Why?

- Volume follow-through expected

- No exhaustion wicks

- Clean structure — no chop, no mess

Here’s my setup:

- Buy Zone: $507–509

- Stop: $503

- Target 1: $520

- Target 2: $530–535

Bias: 🔥 Bullish

Risk: 🔺 Moderate (due to earnings volatility in 2 weeks)

Pattern Watch: Bull Flag continuation

This is exactly the kind of trade I like to see after a clean coil breakout — just don’t FOMO the top wick. Wait for the dip, ride the push.