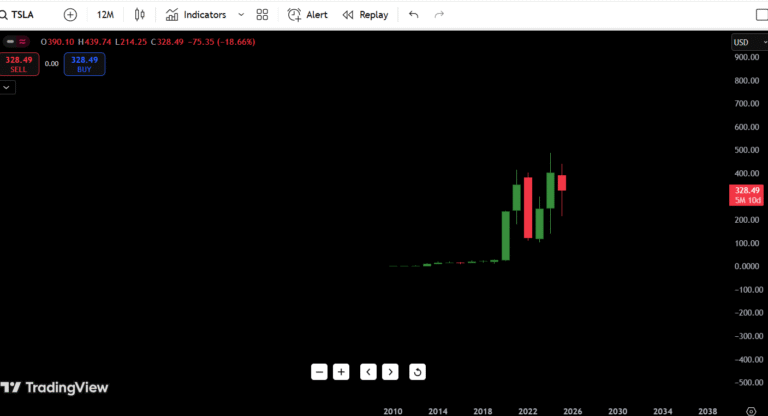

Tesla (TSLA) Stock Analysis – July 23, 2025

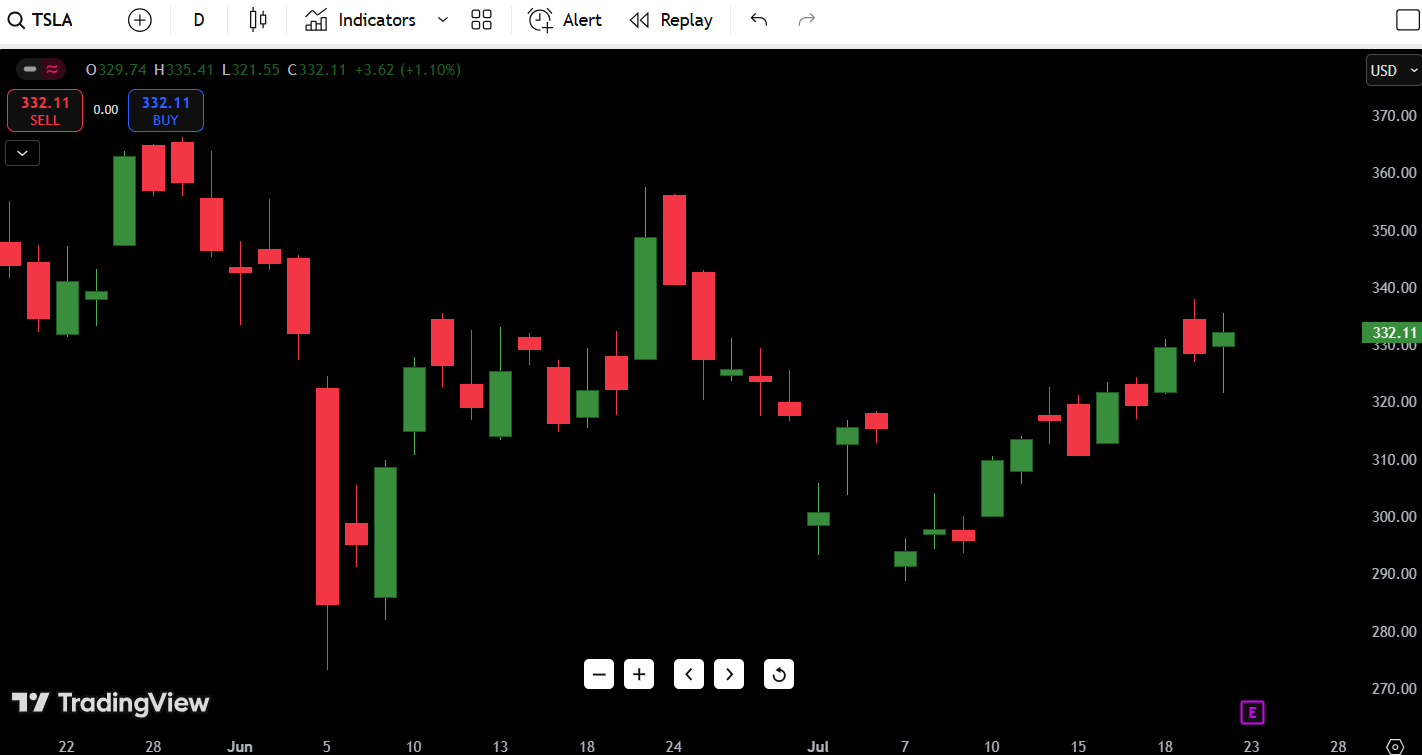

As of July 23, 2025, Tesla Inc. (TSLA) stock is trading at $332.11, up +1.10% on the day after holding above key support near $310. With the bulls pressing for continuation, Tesla is showing a potential bullish breakout setup just ahead of a minor resistance zone.

- TSLA Stock Price Today: $332.11

- Tesla Forecast (July 23): Bullish above $326

- Daily Direction: Uptrend continuation

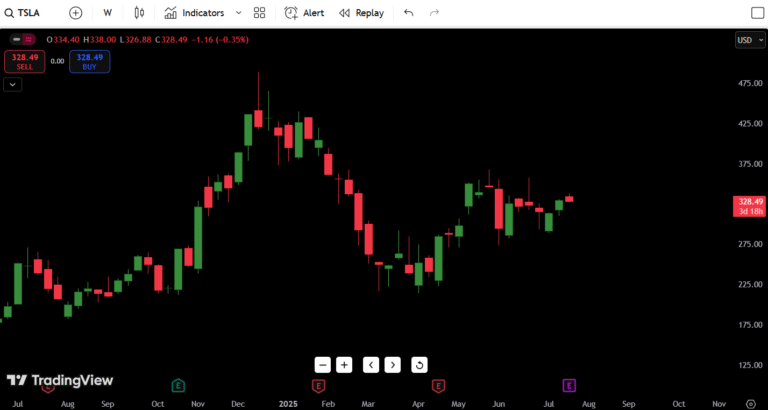

- 52-Week High: $384.29

- 52-Week Low: $193.60

- Key Support: $310.00

- Key Resistance: $336.00

Critical Note: TSLA just printed another strong green candle with a higher low, continuing a clean bullish trend off the $271 low set earlier this month. Momentum buyers are returning, and volume has begun to build — setting the stage for a potential breakout.

Contents

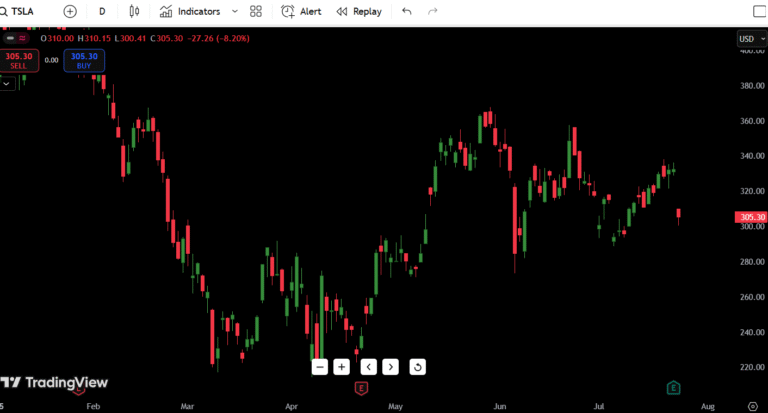

Candlestick Chart Analysis – Tesla’s Bullish Momentum Builds

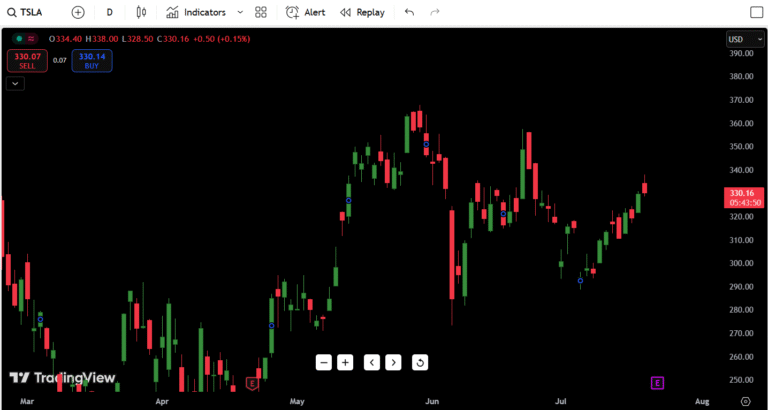

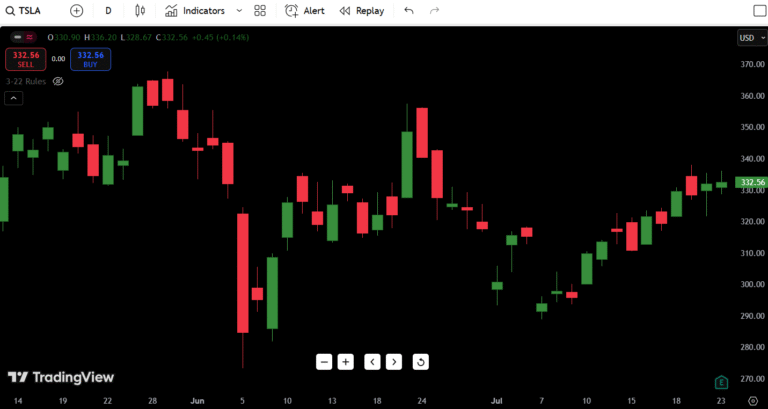

The daily TSLA chart shows a well-defined short-term uptrend that began in early July after price bottomed around $271. Since then, we’ve seen a classic stair-step pattern of higher highs and higher lows, ideal for bullish continuation.

Recent Technical Observations:

- Trend: Strong bullish momentum since July 5

- Candlestick Formations:

- Bullish engulfing (July 5) kicked off the rally

- Inside bar breakout (July 15–16) confirmed uptrend

- July 23 candle shows conviction: higher high + higher close

- Volume Behavior:

- Volume was declining during the June dip

- Bullish candles in July are now accompanied by increasing volume, indicating institutional interest returning

- Market Structure Shift:

- Clear reversal off demand near $271

- Break above $322 confirmed swing low structure

- Price is approaching supply near $336–343 — a potential breakout zone

This price action structure is typical of a controlled accumulation cycle following a correction. As long as TSLA holds above $322–326, the uptrend remains intact. Break and hold above $343.50, and we may see a retest of $360+.

TSLA Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $336.00 | Local resistance zone (swing high) |

| Resistance 2 | $343.50 | Breakout trigger + prior top wick |

| Resistance 3 | $360.00 | Late May swing high |

| Resistance 4 | $384.29 | 52-week high |

| Support 1 | $322.00 | Key short-term higher low |

| Support 2 | $310.00 | Prior breakout and demand zone |

| Support 3 | $296.00 | Volume shelf and psychological |

| Support 4 | $271.00 | July low and reversal base |

Bolded Level Focus: Watch $336.00. If TSLA breaks and closes above this with volume, we could see a swift move to $343.50–$360.

7-Day Price Forecast Table – TSLA Outlook

| Date | High | Low | Expected Close |

|---|---|---|---|

| Day 1 (Jul 24) | $336.50 | $328.00 | $333.50 |

| Day 2 (Jul 25) | $340.00 | $330.50 | $338.25 |

| Day 3 (Jul 26) | $343.50 | $334.00 | $342.75 |

| Day 4 (Jul 27) | $346.00 | $338.50 | $344.00 |

| Day 5 (Jul 28) | $351.00 | $340.00 | $348.50 |

| Day 6 (Jul 29) | $355.00 | $343.00 | $353.00 |

| Day 7 (Jul 30) | $360.00 | $345.50 | $356.25 |

Forecast Logic:

If Tesla continues to print higher lows while holding above $322, the path of least resistance points toward $343.50, then $360. The critical zone to watch is the breakout attempt near $336. A rejection at $343 could cause a pullback to $310–$315 before any new leg higher.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $343.50 | Breakout confirmation with volume |

| HOLD | Between $322–$343 | Bullish range – wait for breakout |

| SELL | Break below $310.00 | Breakdown below demand and trend |

Trade Strategy Discussion:

At current levels, TSLA offers a solid risk/reward for active swing traders. Here’s how I’d approach it:

- Buy on Breakout: A confirmed close above $343.50 with volume = long entry. Target: $360–$384.

- Hold: If price consolidates between $322–$336, patience is key. This zone is the coil before the spring.

- Sell or Avoid: A break and close below $310.00 suggests failed bullish structure. In that case, TSLA may revisit $296 or even $271.

In short: Only get aggressive on long trades above $343 — until then, manage risk with tighter stops.

Fundamental Triggers – What Could Move TSLA Next?

While the chart paints a bullish picture, macro and company-specific catalysts can add fuel (or fear):

Upcoming Earnings:

- Earnings Date: Expected around July 30, 2025

- Expect high volatility the week of earnings — either a breakout or bull trap could occur

Macro Triggers:

- Fed’s July statement (possible rate cut pause or dovish tone could lift growth stocks)

- Energy/EV sector flows — watch how peers like RIVN, NIO, and F trade

Analyst Sentiment:

- Recent upgrades by Morgan Stanley and Wedbush in early July sparked a bullish reversal

- Institutional accumulation is visible in volume profiles

Final Thoughts – TSLA Stock Forecast & Outlook

Overall, Tesla (TSLA) is showing strong signs of bullish continuation after reclaiming control of its trend from the $271 low.

Bullish Setup Highlights:

- Trend: Higher highs + higher lows

- Breakout watch: $336–$343.50 zone

- RSI not overheated (based on context)

- Volume building on green days = strength

Risks to Watch:

- Earnings whipsaw volatility

- Market-wide pullbacks

- Rejection at resistance = fakeout trap

In my experience, these tight channel trends after bottoming can be deceptive — if bulls don’t follow through above $343.50 soon, expect a pullback trap to shake out weak hands before any real continuation.