Amazon (AMZN) Stock Analysis – July 23, 2025

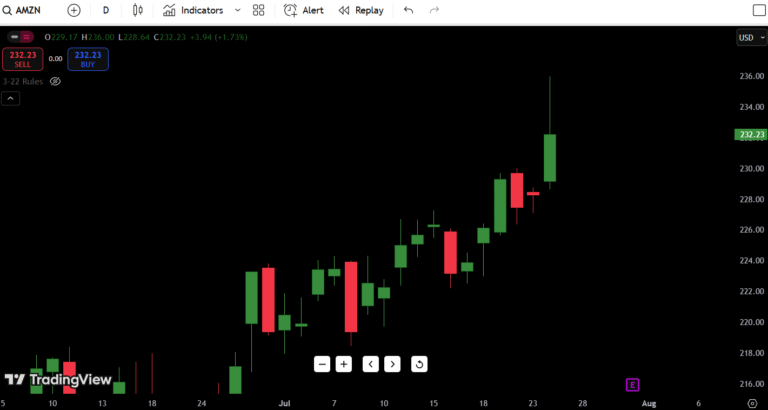

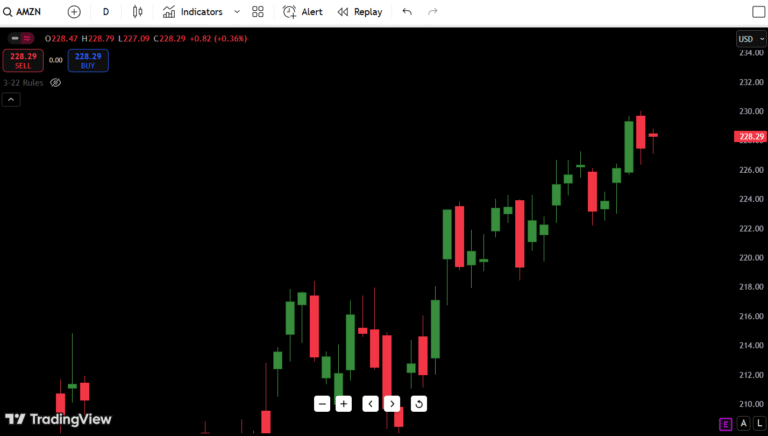

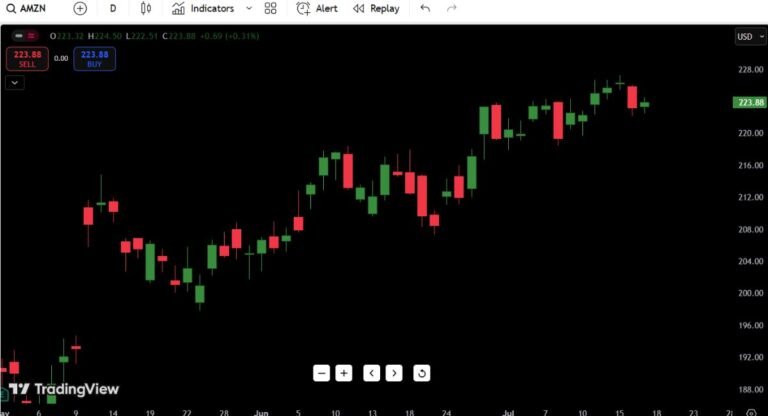

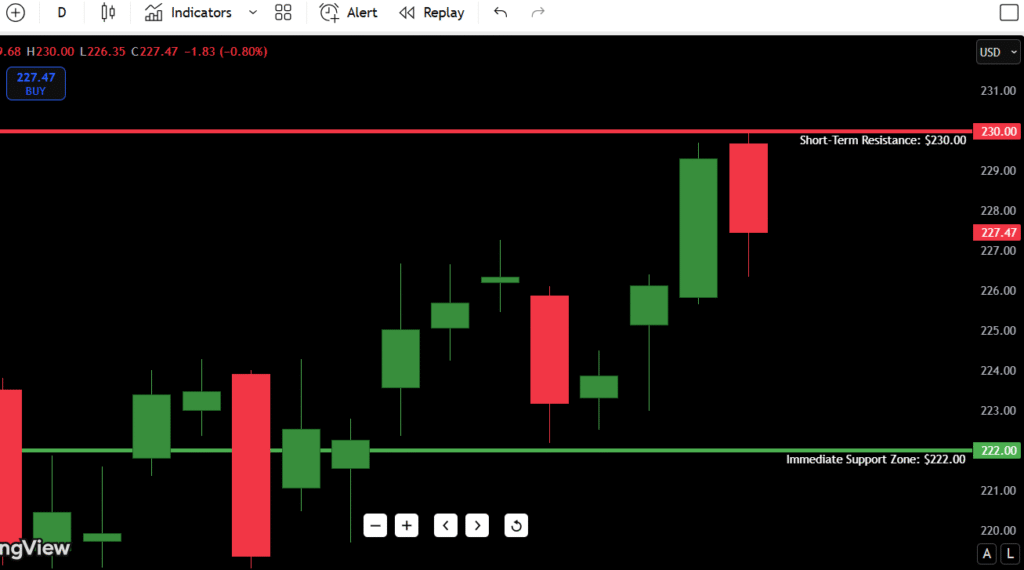

As of July 23, 2025, Amazon stock price today is $227.47, down 0.80% on the day after hitting $230.00 and fading back into support. It’s the second time this month that AMZN has tapped that zone and failed to follow through.

The price action today is mildly bearish, printing a red daily candle with a long wick—often a sign of buying exhaustion or distribution. Traders eyeing the Amazon candlestick chart should note that this recent stall comes after a steep run-up from mid-June, when the stock was trading near $188.50.

- Amazon stock price on July 23: $227.47

- 52-Week High: $233.84

- 52-Week Low: $118.35

- Short-Term Resistance: $230.00

- Immediate Support Zone: $222.00–$223.00

If Amazon can reclaim and close above $230, we could see an aggressive continuation to retest its 52-week high. But a failure to hold above $222.00 could spark a short-term correction toward the $216–$217 support cluster.

Contents

- Candlestick Chart Analysis: Price Action Breakdown

- 🔸 Uptrend Confirmed… But Slowing

- 🔸 Today’s Candle: Bearish Rejection

- 🔸 Volume and Volatility

- 🔸 Watch This Pattern

- Support and Resistance Levels Amazon

- 🔍 Key Zone to Watch: $222.00

- 4. 7-Day Price Forecast for AMZN

- 📈 Forecast Logic:

- 5. Buy, Hold, or Sell Decision Table

- 🧠 Trade Strategy Insight:

- 6. Fundamental Triggers to Watch

- 🧾 Earnings Report – Early August

- 📉 Fed Decision & Interest Rate Volatility

- 📦 E-Commerce Macro Trends

- 💰 Institutional Rotation

- 7. Final Thoughts: Trade Setup and Risk Zones

- 🎯 Outlook: Cautiously Bullish

- 🧭 Key Levels:

- 🧠 Trader Insight:

Candlestick Chart Analysis: Price Action Breakdown

The Amazon candlestick chart as of July 23 shows a textbook example of a stock entering a stall phase after a sharp rally.

Let’s walk through the price action like a trader:

🔸 Uptrend Confirmed… But Slowing

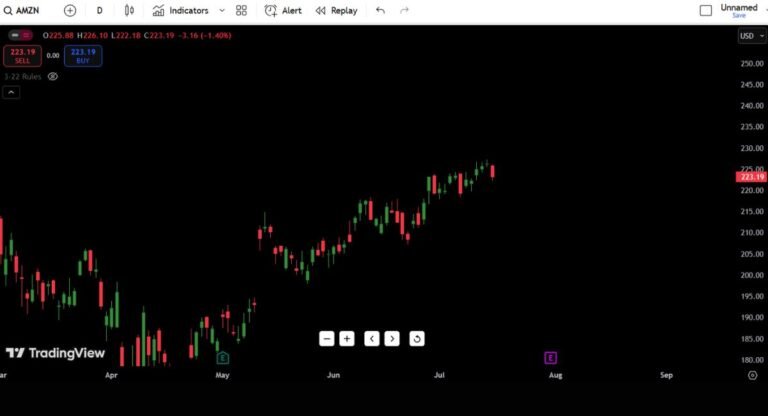

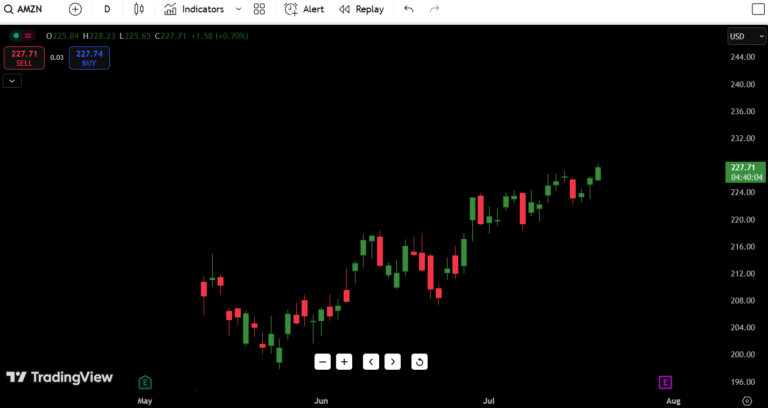

Amazon has printed a clean series of higher highs and higher lows since bottoming in mid-June around $188.50. However, momentum appears to be stalling just under $230—a level that’s now acted as resistance twice in July.

🔸 Today’s Candle: Bearish Rejection

- Candle: July 23 shows a long upper wick and red close — a classic rejection candle

- Price Action: High of day was $230.00, but sellers drove it back to close at $227.47

- Structure: This is a possible lower high intraday, which could shift momentum in the short term

🔸 Volume and Volatility

While volume isn’t visible on this screenshot, the price behavior implies supply at $230. Multiple candles in recent sessions show upper wicks near this level — indicating that sellers are stepping in early and demand is weakening near highs.

🔸 Watch This Pattern

If Amazon puts in another red day tomorrow, we could see a short-term swing high form. That could trigger a mean reversion move toward the rising support around $222–$223 — or even deeper into the $216–$217 zone, which was a prior breakout level.

Support and Resistance Levels Amazon

Here are the major levels to watch, based on recent structure:

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $230.00 | Rejected July 23 – major ceiling |

| Resistance 2 | $233.84 | 52-week high |

| Resistance 3 | $238.00 | Measured move breakout target |

| Resistance 4 | $245.00 | Psychological round number target |

| Support 1 | $222.00 | Recent higher low and base |

| Support 2 | $216.50 | Bullish breakout retest zone |

| Support 3 | $211.00 | June 28 pullback low |

| Support 4 | $188.50 | June swing low – major support |

🔍 Key Zone to Watch: $222.00

This is the pivot level for short-term sentiment. Hold above, and bulls stay in control. Lose this zone, and momentum could unwind quickly.

4. 7-Day Price Forecast for AMZN

Here’s what the next 7 trading days may look like, based on structure and volatility expectations:

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 24 | $229.50 | $223.50 | $225.00 |

| July 25 | $228.00 | $221.50 | $222.70 |

| July 26 | $226.00 | $219.50 | $221.30 |

| July 27 | $224.00 | $218.00 | $219.00 |

| July 28 | $223.00 | $216.00 | $217.50 |

| July 29 | $221.00 | $215.50 | $219.20 |

| July 30 | $224.00 | $218.00 | $221.80 |

📈 Forecast Logic:

If AMZN can hold above $222 into midweek, we could see consolidation followed by a fresh breakout test toward $230. But if we see two red daily closes, odds increase for a flush toward $216–$217, which would still be within the uptrend — just a deeper pullback.

5. Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $230.00 | Clean breakout with confirmation |

| HOLD | Range between $222–$230 | Consolidation, no clear direction |

| SELL | Close below $222.00 | Breakdown of short-term structure |

🧠 Trade Strategy Insight:

Buy:

Traders looking for a breakout entry should wait for a daily close above $230.00 with follow-through. A breakout above this zone could target $233.84 quickly and even $238–$240 in a squeeze.

Hold:

If AMZN continues to grind between $222 and $230, this is a no-trade zone for trend followers. Let price commit to a direction.

Sell:

A break and close below $222.00 would confirm the current high as a short-term top. That opens the door to a pullback into $216.50, or even $211.00, where buyers are likely to reload.

6. Fundamental Triggers to Watch

While the technicals are clearly defined, here are upcoming macro and micro catalysts that could sway Amazon stock:

🧾 Earnings Report – Early August

- Analysts will focus on AWS revenue growth, ad revenue, and margins.

- Guidance will be key. Any softness on consumer strength or logistics efficiency could weigh heavily on valuation.

📉 Fed Decision & Interest Rate Volatility

- If the Fed signals continued hawkishness, tech/growth names like AMZN could face pressure.

- On the flip side, any hint at rate cuts in Q4 would be rocket fuel for Amazon’s valuation.

📦 E-Commerce Macro Trends

- Amazon is a bellwether for global e-commerce. A slowdown in consumer spending (e.g., weaker retail sales) may hurt AMZN sentiment in the short term.

💰 Institutional Rotation

- Watch fund flows into tech vs cyclicals. A shift out of mega-cap tech into energy or financials could drag AMZN, regardless of individual strength.

7. Final Thoughts: Trade Setup and Risk Zones

Amazon is at a make-or-break level. After a powerful rally off the $188.50 base, the stock is now stalling just beneath key resistance at $230.00.

🎯 Outlook: Cautiously Bullish

- Structure still supports higher prices

- But today’s rejection candle signals potential short-term weakness

🧭 Key Levels:

- Bullish Breakout Trigger: Close above $230.00

- Bearish Breakdown Trigger: Close below $222.00

🧠 Trader Insight:

“In my experience, when a stock prints multiple rejection candles near resistance—like AMZN has at $230—it often means smart money is unloading into late buyers. I’m not touching this long unless we get a clean breakout above $230 with volume. Otherwise, I’m watching for a fade back to $216–$217 with a tight stop.”

If you’re a short-term trader, this is a high-risk, low-reward zone until a breakout or breakdown confirms. Stay patient and let price show its hand.