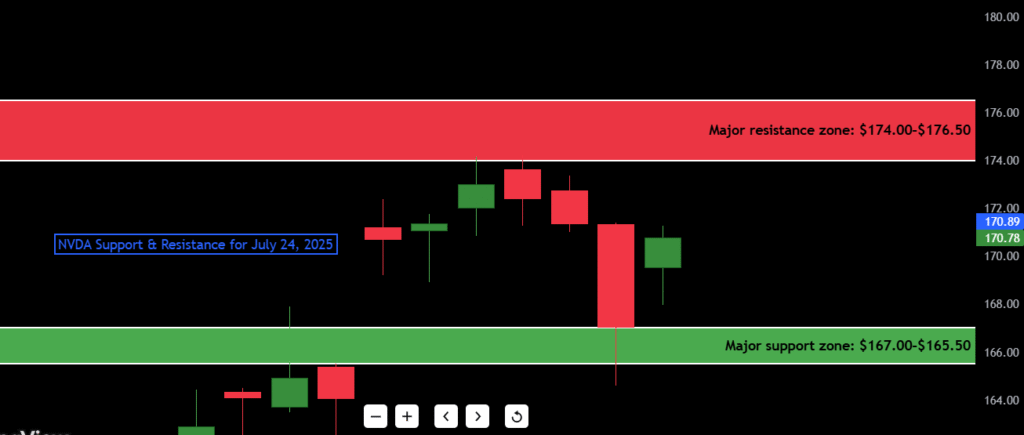

As of July 24, 2025, NVIDIA (NVDA) is trading at $170.78, bouncing from a session low of $167.97 after a multi-day slide. Despite today’s green candle, NVDA is still down from its recent peak near $174.50, and traders are watching closely to see if this recovery is the start of a bullish reversal or just a dead-cat bounce before more downside.

The NVDA stock price today is sitting right between two critical battle zones: resistance near $174 and a growing support shelf in the $167–$168 range. The stock is up 2.25% today, signaling short-term buyers stepped in near support — but momentum remains shaky after three red days in a row.

Here’s what stands out:

- NVIDIA (NVDA) Stock Price July 24: $170.78

- 52-week high: $181.65

- 52-week low: $108.13

- Major resistance zone: $174.00–$176.50

- Major support zone: $167.00–$165.50

The price action today showed buyers defending the dip, but we’re not out of the woods yet. There’s overhead pressure, and unless NVDA clears the $174 resistance, this could remain a range-bound or fading setup into next week.

- Must Read My Previous Day NVDA Stock Analysis before Trust

Contents

Candlestick Chart Analysis

Let’s zoom into the chart and talk real trader language.

The first thing to note is the overall trend is still up, but momentum has cooled after a powerful July rally that peaked near $174.50. The past few sessions have printed a short-term pullback, including a heavy red candle on July 22, which likely trapped some late longs near the top.

That July 22 candle is key — it was a large-range red bar that closed below the prior two sessions, signaling a bearish engulfing continuation. The next day followed through with more selling but printed a long lower wick, hinting at early dip-buying interest. Today (July 24), we’ve printed a strong bullish recovery candle, closing at $170.78, which reclaims part of that recent selloff.

Breakdown:

- July 17–19: Topping structure with small-bodied candles and lower highs.

- July 22: High-volume sell candle with a long body — a possible liquidity flush.

- July 23: Intraday reversal with a long wick — early signal of demand reappearing.

- July 24: Green candle closing near high of day — buyers reclaim initiative, but still inside prior range.

This three-bar sequence hints at a potential bullish reversal, but for confirmation, bulls need a close above $172.50, ideally backed by stronger volume.

The market structure right now is in a short-term consolidation, caught between recent swing highs and demand support. No confirmed breakout or breakdown yet, which means traders should stay tactical and wait for a decisive close outside the range.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $174.50 | Recent swing high |

| Resistance 2 | $176.20 | Breakout trigger |

| Resistance 3 | $181.65 | 52-week high |

| Resistance 4 | $184.00 | Gap-fill zone |

| Support 1 | $167.00 | Daily demand zone |

| Support 2 | $165.40 | Key bounce level |

| Support 3 | $162.75 | Last major low |

| Support 4 | $158.90 | 52-week low |

$167.00 is the line in the sand. If NVDA holds this zone, bulls can look for a breakout retest. Lose it with volume, and the chart opens downside to the $165 and $162.75 support zones.

7-Day Price Forecast Table

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 25 | $172.60 | $169.00 | $171.30 |

| July 26 | $174.20 | $170.50 | $173.50 |

| July 27 | $176.00 | $172.30 | $175.20 |

| July 28 | $177.80 | $173.10 | $174.50 |

| July 29 | $176.00 | $171.80 | $173.00 |

| July 30 | $174.00 | $169.70 | $170.20 |

| July 31 | $172.50 | $168.60 | $169.50 |

Forecast logic: If NVDA can hold above the $167 support zone for the next two sessions and close above $172, we may see a breakout test toward $174–$176. However, a failure to break $174 convincingly could trigger a lower high rejection, and sellers may push it back toward $165–$162.75 later in the week.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $174.50 | Breakout confirmed with volume |

| HOLD | Range between $167–$174 | Choppy action, unclear direction |

| SELL | Break below $167.00 | Bearish breakdown confirmation |

Buy if: NVDA closes above $174.50 with strong volume — this would confirm a break above the short-term range and possibly target $176–$178 next.

Hold if: The stock remains range-bound between $167 and $174. The indecision here makes it a low conviction zone, especially for directional trades.

Sell if: We get a close below $167, especially with a wide red candle and pickup in volume — this signals a likely revisit of lower support around $165 or even $162.75.

From a risk/reward perspective, traders should be patient here — the next 1–2 sessions are critical in determining short-term direction.

Fundamental Triggers

NVDA isn’t just a technical story — fundamentals and sentiment are in play:

- Next earnings date: Expected mid-August (exact date TBD)

- Semiconductor sector performance: AMD, INTC, and SMH ETF are offering clues. Weakness here could weigh on NVDA.

- AI and Data Center commentary: Any news from hyperscalers like Amazon or Microsoft about slowing AI chip orders could create downside pressure.

- Macro triggers: Any upcoming Fed commentary or inflation print could move tech broadly, and NVDA won’t be immune.

- Institutional flows: NVDA remains a top 5 holding in many ETFs. Watch for unusual volume or dark pool spikes.

This chart is not just retail-driven — hedge funds and institutions are actively trading NVDA, and that means sudden spikes or reversals can occur quickly around event catalysts.

Final Thoughts

Outlook: Cautiously Bullish — but only above $172.50.

NVDA’s price action today is promising for bulls, but we need confirmation. The recovery from $167 shows buyers stepping in, but $174 remains a serious wall. If bulls want control, they must reclaim and hold that zone. Otherwise, this could just be a bear market rally inside a short-term correction.

Key zones to watch:

- $174.50 resistance — clear this, and it’s a breakout.

- $167.00 support — lose this, and we’re heading lower.

- $172.50–$173.50 — key intraday battle zone for breakout or fade.

From a trader’s lens:

I’ve seen these setups before — a fake bounce after a three-day pullback that traps buyers before fading again. If we don’t get strong follow-through tomorrow, I’d be cautious chasing upside. On the flip side, if we see NVDA grind back into $173+ with tight consolidation and volume support, it could be the beginning of a larger leg higher.

Traders should stay nimble, define their risk zones, and let the chart do the talking. NVDA is at a decision point, and whichever side wins this battle near $172–$174 could control the next $10 move.