Amazon (AMZN) Stock Analysis – July 22, 2025

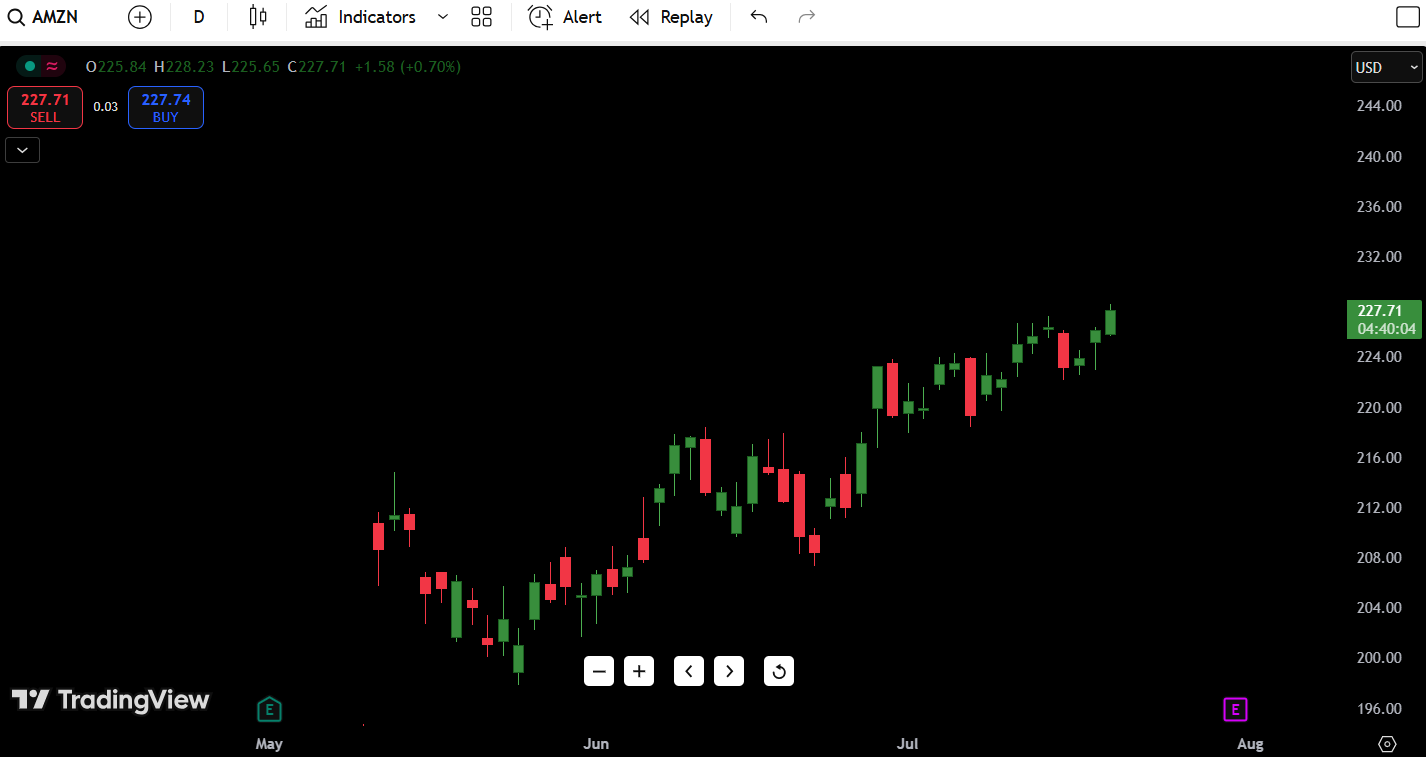

Amazon (AMZN) continues to grind steadily higher as of July 22, 2025, building on a multi-month uptrend. The stock closed today at $227.71, gaining +0.70% as buyers continue to defend dips and push price action toward the upper end of its recent range.

- Current Price: $227.71

- Daily Direction: Bullish continuation

- 52-Week High: $244.00

- 52-Week Low: $196.00

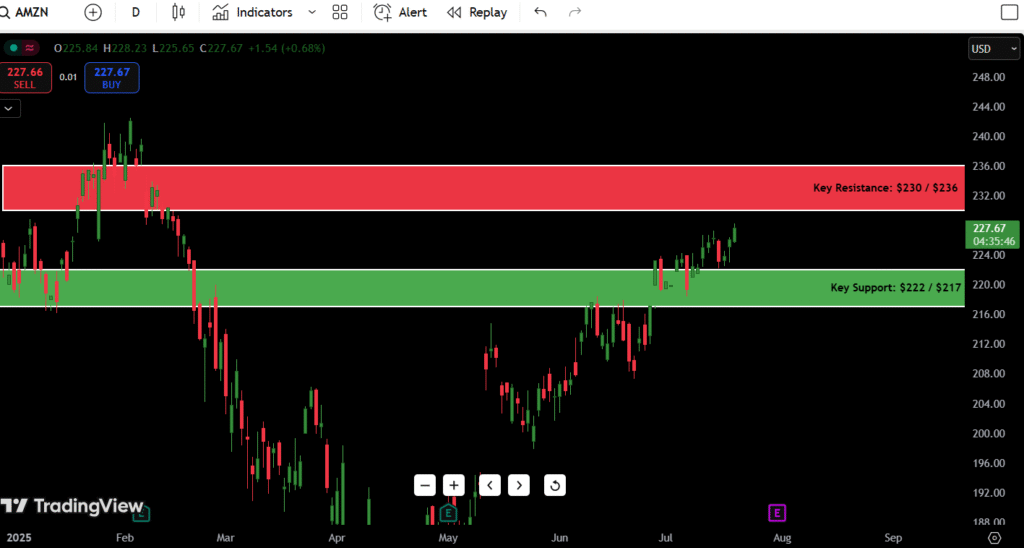

- Key Support: $222 / $217

- Key Resistance: $230 / $236

Contents

- Observation for July 22:

- Candlestick Chart Analysis for July 22 Outlook

- Trend Overview:

- Recent Candlestick Behavior:

- Market Structure:

- Volume Profile (Visual Assessment):

- Support and Resistance Levels Table

- 7-Day Price Forecast Table (Starting July 22)

- Forecast Logic:

- Buy, Hold, or Sell Decision Table

- Current Bias:

- Fundamental Triggers

- Upcoming Events Impacting AMZN Stock Forecast:

- Final Thoughts for July 22, 2025

- Outlook: Bullish with caution near $230.

- Critical Zones to Watch:

- My Trading Insight (Trader’s Perspective):

Observation for July 22:

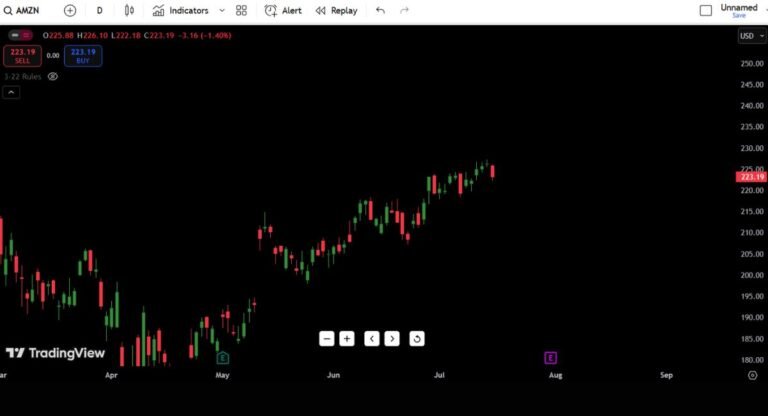

AMZN has been quietly stair-stepping higher for weeks, avoiding any major pullbacks. While momentum isn’t explosive, the price structure remains strongly bullish with clear higher lows. A close above $230 would likely trigger momentum traders looking for that next push toward $240–$244.

Candlestick Chart Analysis for July 22 Outlook

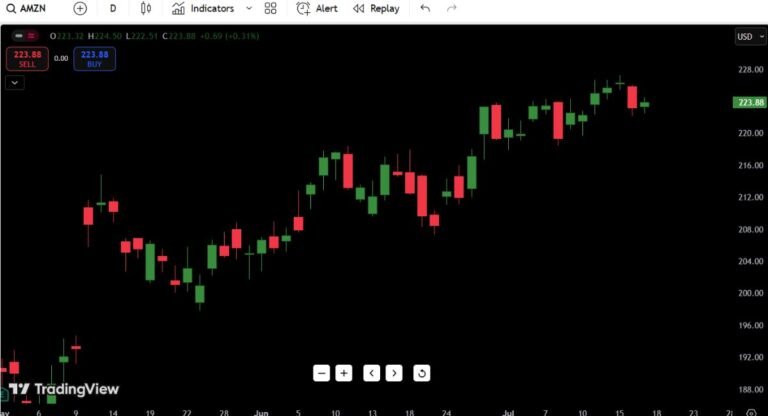

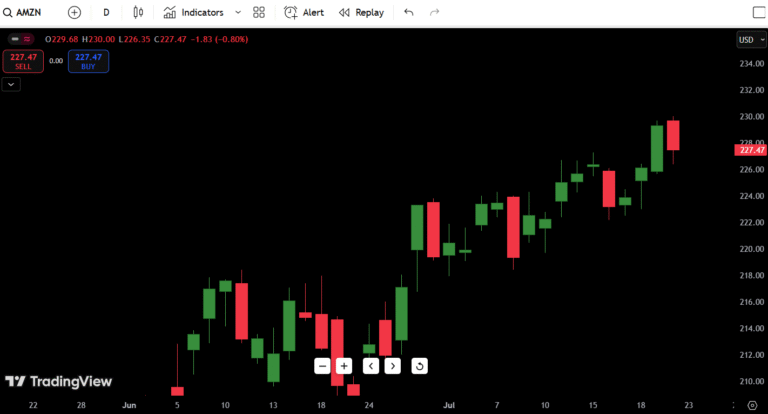

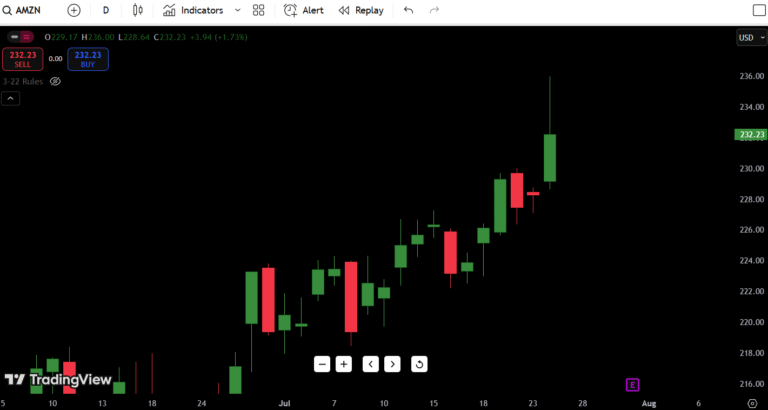

Trend Overview:

Amazon is firmly within a bullish uptrend stretching from late May through July. Price action continues to respect the trendline and short-term moving averages, suggesting institutional support behind this slow grind higher.

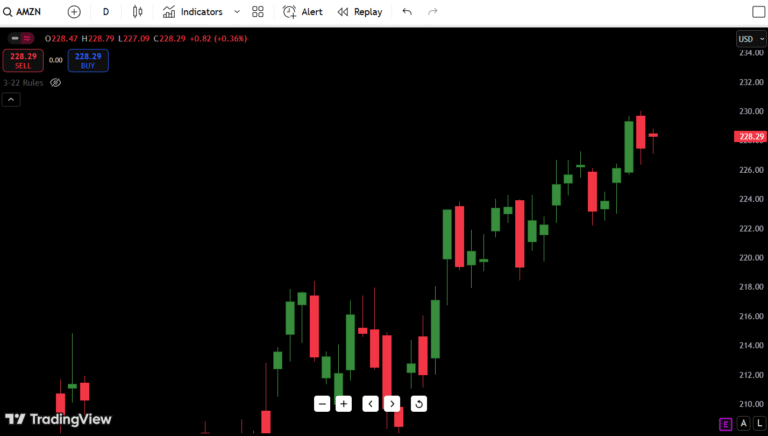

Recent Candlestick Behavior:

- Today’s candle closed green, near session highs, reflecting ongoing strength.

- The past two weeks show a series of small-bodied bullish candles — a healthy staircase formation typical of sustained bullish trends.

- No signs of exhaustion or aggressive selling; buyers are in control.

Market Structure:

- Short-Term: Bullish grind higher

- Medium-Term: Approaching significant resistance between $230–$236

- Long-Term: Working its way back toward 52-week highs at $244

Volume Profile (Visual Assessment):

- Volume remains consistent, not euphoric. That’s common during methodical bullish advances.

- No major spikes signaling exhaustion; steady accumulation behavior continues.

Summary: AMZN remains in control of bulls. Breaks above $230 open the path for acceleration toward $240+. However, extended grinding trends can stall near round number zones without fresh catalysts.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $230.00 | Current swing target / breakout zone |

| Resistance 2 | $236.00 | Previous rejection zone |

| Resistance 3 | $240.00 | Round number, psychological level |

| Resistance 4 | $244.00 | 52-week high |

| Support 1 | $222.00 | Recent breakout retest |

| Support 2 | $217.00 | Former consolidation base |

| Support 3 | $210.00 | Prior bounce zone |

| Support 4 | $196.00 | 52-week low |

Key Level: $230 breakout potential. If buyers can confirm above $230, the next leg higher toward $240–$244 becomes highly probable.

7-Day Price Forecast Table (Starting July 22)

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 22 | $228 | $225 | $227 |

| July 23 | $231 | $226 | $230 |

| July 24 | $233 | $229 | $232 |

| July 25 | $236 | $230 | $235 |

| July 26 | $238 | $232 | $236 |

| July 27 | $240 | $235 | $238 |

| July 28 | $242 | $238 | $240 |

Forecast Logic:

Provided AMZN holds above $222–$225 support, this bullish structure remains intact. Breakouts above $230 are likely to invite continuation buyers aiming for $240–$244. Failure to hold $222 would shift short-term bias to neutral.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $230 | Breakout confirmed with volume |

| HOLD | Range between $222–$230 | Bullish structure intact, awaiting breakout |

| SELL | Break below $222 | Breakdown of recent bullish support |

Current Bias:

Neutral-to-Bullish. While AMZN hasn’t fully broken out yet, the trend favors bulls. A close above $230 with volume confirmation would trigger a buy setup targeting $240+. As long as price respects $222–$225, patience favors long bias.

Fundamental Triggers

Upcoming Events Impacting AMZN Stock Forecast:

- Earnings Season: AMZN is approaching another earnings report cycle; guidance updates could heavily impact sentiment.

- Consumer Spending Data: Amazon’s revenue is sensitive to macro consumer trends — positive retail sales data boosts outlook.

- Sector Strength: Tech remains strong, but rotations into AI or semiconductors can momentarily slow AMZN momentum.

- Interest Rates: Fed comments this week could affect risk-on appetite for growth stocks like AMZN.

- Institutional Activity: Watch large blocks and options positioning for signs of bigger players positioning for Q3 upside.

Final Thoughts for July 22, 2025

Outlook: Bullish with caution near $230.

Amazon stock continues to perform within a healthy bullish channel. There’s no reason to fight the trend here. However, traders should recognize that extended moves often pause at round number resistance. $230 is a battle zone. Clean breaks above target $236–$240, but rejections could lead to tests back toward $222.

Critical Zones to Watch:

- Immediate Breakout Zone: $230

- Must-Hold Support: $222

- Upside Magnet: $240–$244

- Risk Zone: Below $217 would break structure

My Trading Insight (Trader’s Perspective):

Slow, controlled trends like AMZN’s are trader favorites because they offer clear risk/reward setups. However, they demand patience. Chasing extended candles into resistance rarely pays unless there’s clear confirmation with volume.

In my view, a close above $230 opens the door for another quick 3–5% leg higher. If we see AMZN stall under $230, I’ll watch closely for dip opportunities back toward $222–$225.

Protecting capital remains key — trends like this break slowly and often retest.