Amazon (AMZN) Stock Analysis – July 24, 2025: Buy or Bail?

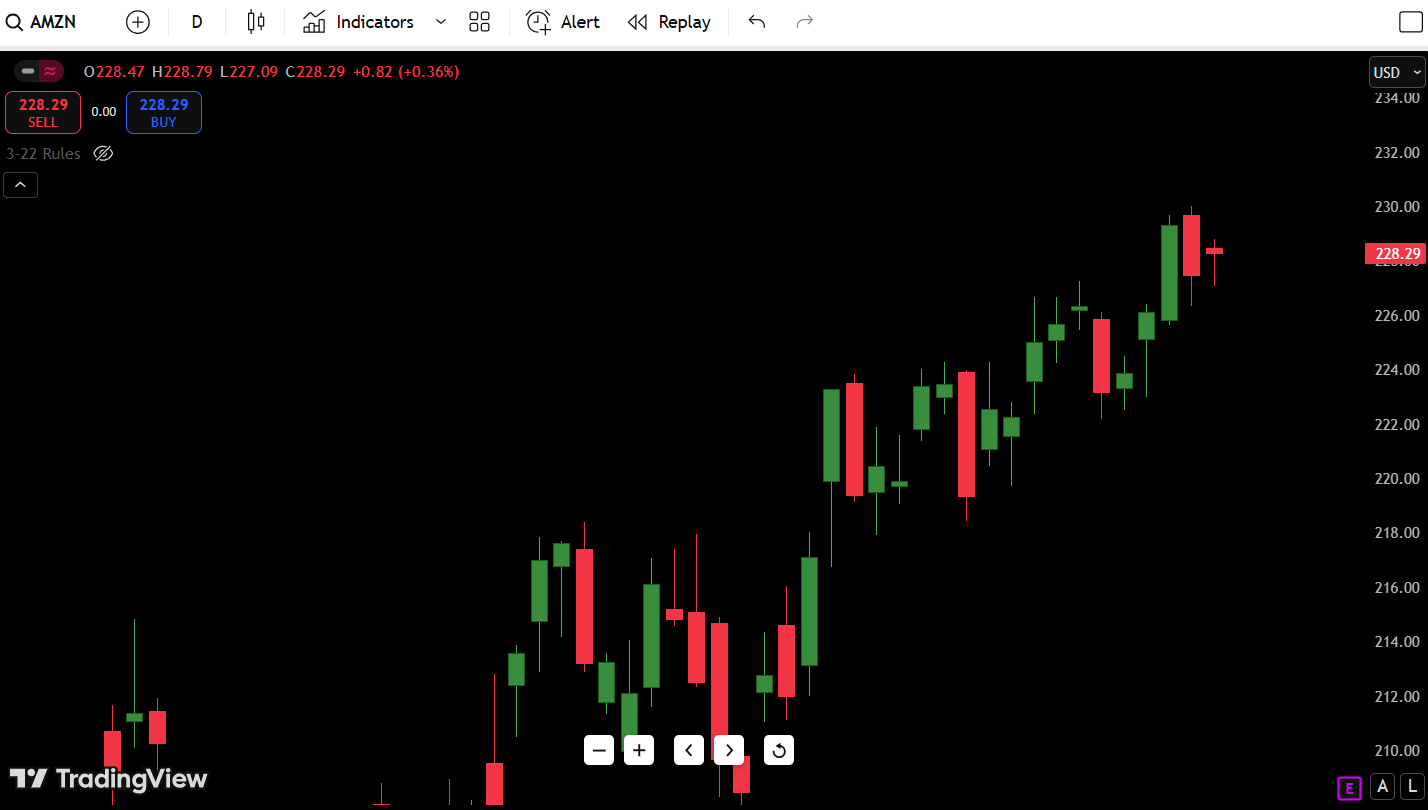

As of July 24, 2025, Amazon (AMZN) is trading at $228.29, not far from its daily high of $228.79. The stock remains in a solid short-term uptrend after reclaiming key structure levels, showing potential for further upside — but traders should stay cautious of a possible lower high trap.

- Apple Current Price July 24: $228.29

- Daily Direction: Bullish Bias

- Amazon Stock Price Prediction for July 24, 2025: Leaning bullish above $226.50

- 52-Week High and Low: $230.45 / $116.56

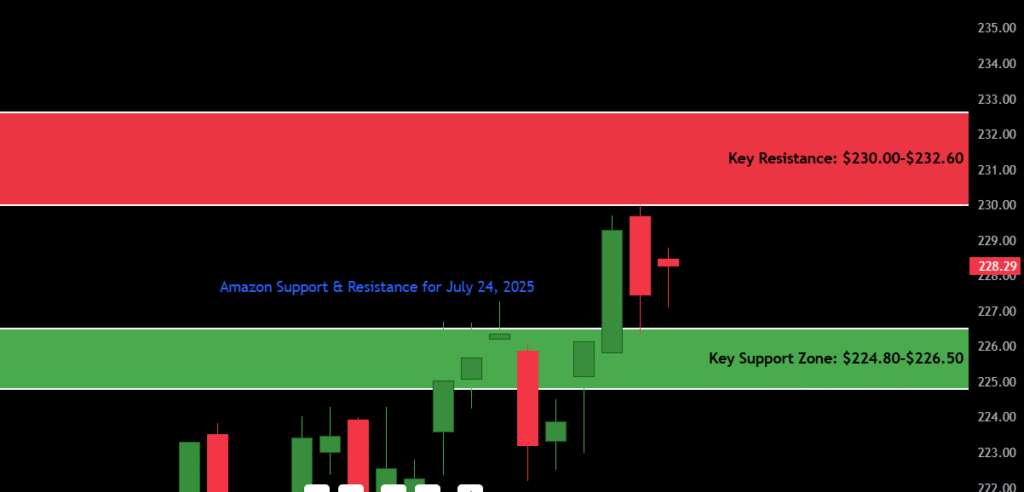

- Key Support Zone: $224.80–$226.50

- Key Resistance: $230.00–$232.60

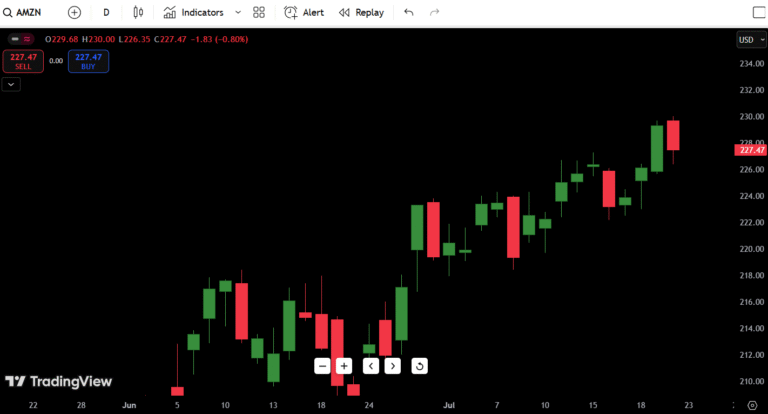

One critical observation: The last few candles show strong buyer presence with consistent higher lows — but today’s candle is forming a potential spinning top, hinting at indecision. That makes the $228.50–$230 zone a pivotal level to monitor for a breakout or a fakeout reversal.

- Previous Day | Amazon (AMZN) Stock Analysis – July 24

Contents

Candlestick Chart Analysis

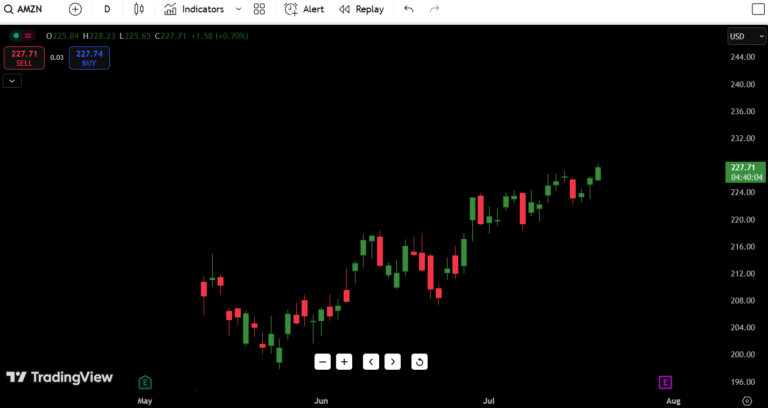

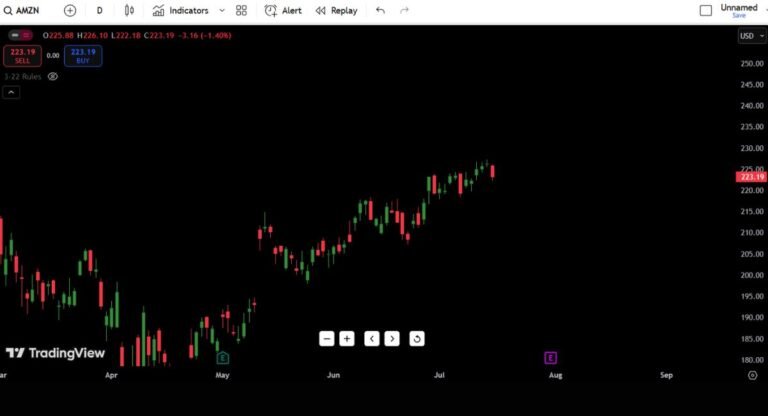

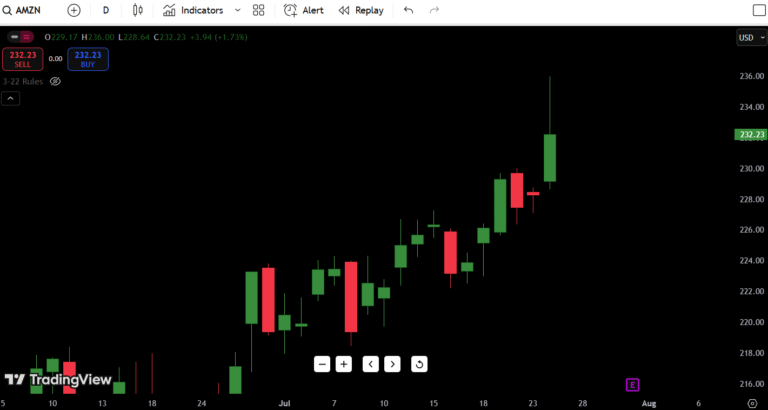

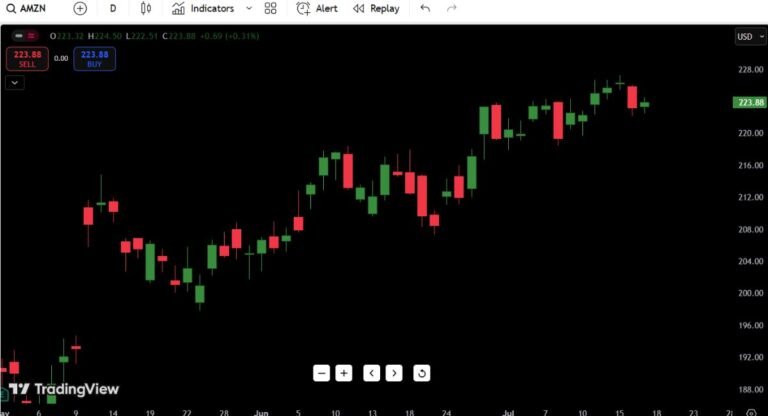

The daily candlestick chart for AMZN shows a clear uptrend forming since mid-July, with multiple bullish engulfing candles and strong continuation wicks.

Here’s what’s jumping out:

- Trend Structure: AMZN broke out of a mini consolidation zone near $215 and pushed past multiple resistance levels with conviction.

- Candlestick Behavior: Recent sessions printed long-bodied green candles with narrow red retracements — classic signs of healthy trend continuation.

- Volume: Volume has been tapering slightly, which may indicate buyer exhaustion or a potential pullback ahead. Keep an eye on volume spikes during resistance tests.

- Today’s Candle: The current candle is printing a small-bodied indecision bar, signaling potential consolidation or a reversal attempt if buyers don’t step in quickly.

- No Clear Reversal Pattern Yet: There’s no major bearish engulfing or evening star structure in sight. This means the uptrend still holds unless $226 is broken.

Overall, AMZN is trending bullish, but bulls need to see a clean close above $230 to confirm a breakout. Otherwise, this might become a classic fakeout to trap breakout buyers.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $230.00 | Round number, current ceiling |

| Resistance 2 | $232.60 | Last supply wick from April |

| Resistance 3 | $238.70 | Near-term breakout expansion target |

| Resistance 4 | $252.90 | 52-week high |

| Support 1 | $226.50 | Short-term demand base |

| Support 2 | $224.80 | Last minor pullback level |

| Support 3 | $220.20 | Higher low from breakout leg |

| Support 4 | $210.00 | Long-term pivot, demand shelf |

The most important level right now is $226.50 — as long as AMZN holds above this, the bullish thesis remains intact. A clean daily close below it could shift sentiment quickly.

7-Day Price Forecast Table

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 24 | $229.50 | $226.00 | $228.10 |

| July 25 | $231.00 | $227.20 | $230.30 |

| July 26 | $232.60 | $229.10 | $231.90 |

| July 27 | $233.40 | $230.50 | $232.00 |

| July 28 | $234.00 | $230.20 | $231.20 |

| July 29 | $235.50 | $231.00 | $234.40 |

| July 30 | $238.00 | $233.50 | $236.70 |

Forecast Insight:

If AMZN can hold above $226.50, expect a grind upward toward the $232.60 zone by the end of the week. However, if price rejects $230 repeatedly and fails to hold $226, a drop toward $220 could play out fast.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $230.20 | Confirmed breakout over key level |

| HOLD | Range between $226–$230 | Tight chop zone, unclear momentum |

| SELL | Break below $226.00 | Trend breakdown, bears regain grip |

Buy Scenario: A daily close above $230.20 with strong volume would confirm a breakout. In that case, price could expand toward the $234–$238 range quickly, offering a 3:1+ risk/reward swing setup.

Hold Zone: If AMZN floats between $226 and $230, it’s best to wait. That’s a liquidity trap zone, often designed to fake out retail traders.

Sell Setup: A decisive break below $226, especially with rising volume, would signal a trend shift. That could open the doors to a correction toward $220 or lower.

Fundamental Triggers

Several upcoming catalysts could affect AMZN stock price today and over the coming week:

- Q2 Earnings: Scheduled for next week — the market is already positioning ahead of this. Any weak guidance could reverse momentum.

- Interest Rate Noise: The Fed’s July policy tone may shake Big Tech sentiment. A hawkish stance could pressure growth names like Amazon.

- Consumer Spending Data: Macro reports around retail and e-commerce trends could directly impact Amazon’s short-term outlook.

- Institutional Flow: Whale accumulation near the $215 level earlier this month was evident in volume bursts. Track if those funds are trimming or holding above $230.

Final Thoughts

Outlook: Bullish Bias — Cautiously Optimistic

Key Levels to Watch:

- Bullish Breakout Trigger: $230.20

- Bearish Breakdown Trigger: $226.00

- Range to Avoid Trading: $226.50–$230

AMZN has printed a textbook uptrend with strong price structure and momentum since the July breakout. But as we sit just below a major psychological and structural resistance at $230, the next few sessions will be critical.

In my experience, rallying into resistance with low volume often sets up a liquidity sweep before a pullback. If we see a strong rejection at $230 again, I’ll be watching closely for a fade trade down to $224–$220. But if bulls step up with conviction, this could be the beginning of a bigger leg toward $240+.

Final Verdict:

Don’t chase the breakout let the candle close confirm it. If you’re already long from lower levels, trail stops below $226 and lock partial profits into strength.