Let’s cut through the noise. Apple just closed at $213.88. Flat day. Not much of a headline grabber unless you’re actually watching price action. And if you’re a trader worth your salt, you are.

We’ve got a tight range, low volume churn, and price action pressing up into resistance. This setup? It’s like a spring getting wound tighter every day. Something’s about to give. And when it does if you’re positioned right—you ride the move. If not, you’re the liquidity.

Let’s dig in.

Contents

- Key Takeaways Before the Bell

- Apple Chart Structure: What Price is Telling Us

- Apple Support & Resistance Levels – Exact Zones

- Support Levels:

- Resistance Levels:

- Apple Buy & Sell Signals – Let’s Get Precise

- Apple Buy Setup (Breakout Play):

- Apple Sell Setup (Breakdown Play):

- Indicators Breakdown (MACD, RSI, MA)

- RSI (Relative Strength Index)

- MACD

- 50/200 Day MAs

- VWAP (if intraday trading)

- Fundamental Context: What’s Moving the Sentiment?

- Recent Headlines

- How the Street Feels

- Trader Psychology: What’s Under the Hood?

- Short-Term Forecast (3–5 Days)

- If AAPL breaks $215.60 with volume

- If AAPL fails again and breaks $210

- Final Thoughts: My Personal Take

- FAQs – Apple Stock Analysis

- Is Apple stock a buy right now?

- What are Apple’s key support and resistance levels?

- Will AAPL go up or down next week?

- What indicators show Apple’s momentum?

- Is it safe to swing trade AAPL this week?

- Final Word to Traders

Key Takeaways Before the Bell

- Current Price: $213.88

- Bull Bias: Price grinding higher above all key moving averages

- Bear Watch: Repeated rejection around $215.20 = caution

- Major Resistance: $215.20 → $217.50 zone (watch closely)

- Key Support: $210.00 → $211.00 zone (buyers have defended)

- Buy Trigger: $215.60+ breakout candle with volume

- Sell Trigger: Break below $209.80 = momentum shift

- Short-Term Target (Bullish): $220.00 then $222.80

- Short-Term Target (Bearish): $204.20 then $198.90

- Risk/Reward Long Setup: 1:2.1 (clean trade)

- RSI: 67 (nearing overbought but no divergence yet)

- MACD: Losing steam, but still bullish

- Volume: Fading = breakout or breakdown imminent

Apple Chart Structure: What Price is Telling Us

Let’s talk structure. Apple’s chart is doing something most people miss: it’s showing strength without screaming it. Here’s the key:

- The recovery off the $170s low was impulsive—multiple large-bodied green candles, very little retrace.

- Since then, we’ve been consolidating above $210 with a clear upward bias.

- What we’re seeing now is a tight range inside a rising channel, sitting just below a key breakout level at $215.20.

This ain’t just random chop. This is institutional positioning. Smart money doesn’t chase—they accumulate. That quiet float upward? That’s accumulation, not hype.

Also worth noting:

- Last three candles are doji-ish, signaling indecision.

- No bearish engulfing yet = no confirmed reversal.

- Price is still making higher lows = bull control.

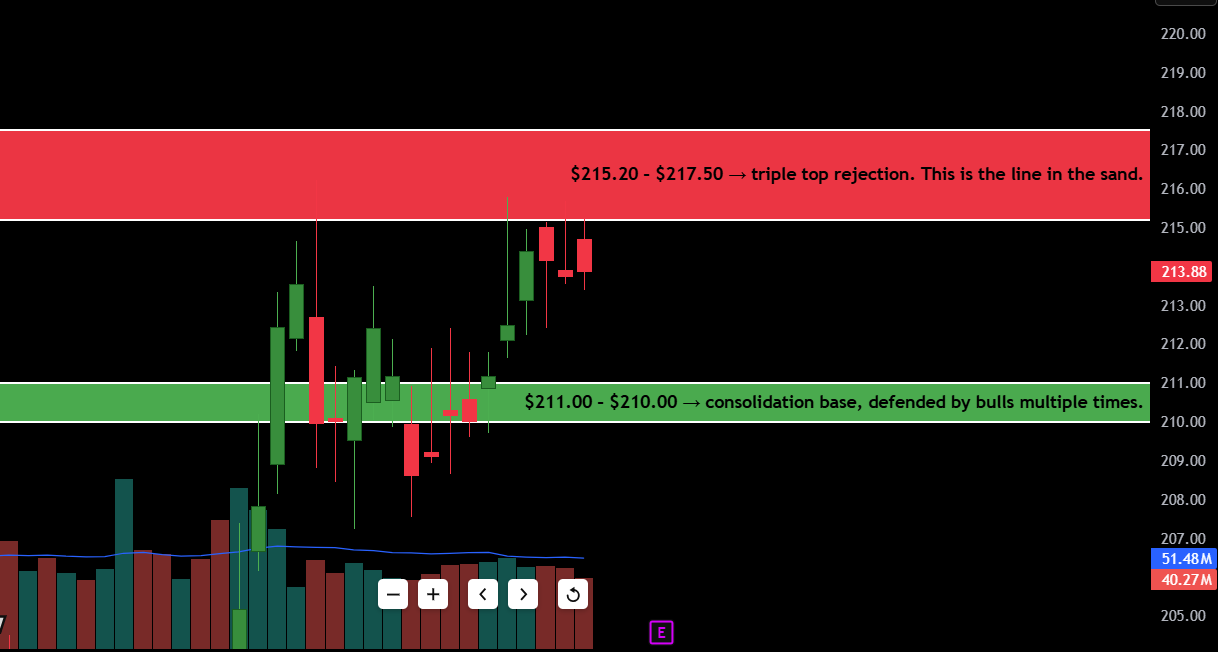

Apple Support & Resistance Levels – Exact Zones

Support Levels:

- $211.00 – $210.00 → consolidation base, defended by bulls multiple times.

- $204.20 → minor gap fill zone.

- $198.90 – $200.00 → major volume shelf, high probability bounce.

Resistance Levels:

- $215.20 – $217.50 → triple top rejection. This is the line in the sand.

- $220.00 – $222.80 → next leg targets on breakout. That’s where profit-takers step in.

Quick Tip for Traders: Draw a box from $210.00 to $215.20 on your chart. That’s your battlefield. Bull win above, bear win below.

Apple Buy & Sell Signals – Let’s Get Precise

Apple Buy Setup (Breakout Play):

- Entry: $215.60 (candle close above resistance)

- Stop-Loss: $211.80

- Target 1: $220.00

- Target 2: $222.80

- Confidence Score: 8.2/10

- Why: Break above compression zone with prior momentum and favorable macro tailwind

Apple Sell Setup (Breakdown Play):

- Entry: Below $209.80

- Stop-Loss: $212.30

- Target 1: $204.20

- Target 2: $198.90

- Confidence Score: 7.4/10

- Why: Breakdown from rising support, MACD cross risk, RSI overextension

Indicators Breakdown (MACD, RSI, MA)

RSI (Relative Strength Index)

- Currently sitting at ~67. That’s flirting with overbought territory, but not overheated.

- The absence of divergence keeps the bull case alive.

- We’d worry only if RSI pops 70+ and price fails to push—classic reversal trap.

MACD

- Bullish cross already in the books

- But histogram is weakening—momentum is stalling, not reversing yet.

- Key Watch: MACD curl or histogram flip = red flag for bulls

50/200 Day MAs

- 50-Day MA = ~$205 and rising

- 200-Day MA = ~$192 and turning slightly up

- Price above both = bull trend confirmed. No debate here.

VWAP (if intraday trading)

- We’re not seeing VWAP on this daily chart, but if you’re intraday scalping—use it against $215. It’s a magnet at this zone.

Fundamental Context: What’s Moving the Sentiment?

Let’s not pretend price action exists in a vacuum. Here’s what traders are factoring into Apple’s setup:

Recent Headlines

- Q3 Earnings Beat: Revenue +5% YoY, EPS in-line. No fireworks, but solid.

- AI Hardware Rollout: Apple’s M3 chip driving Mac demand higher. Services revenue continues to offset iPhone stagnation.

- China Weakness: A risk, but largely priced in.

- US Macro: Fed held rates. Inflation cooling. Tech still leading.

How the Street Feels

- Bulls: “Apple’s not exciting, but it’s a fortress. I’d park cash here over small caps.”

- Bears: “Valuation’s stretched. No new growth catalyst beyond Vision Pro hype.”

- Neutral traders: “Until it clears $217.50, I’m not touching it.”

Sentiment is cautious bullish. And cautious bulls are the best kind—you get clean moves, not blow-off tops.

Trader Psychology: What’s Under the Hood?

This is where it gets real. What’s happening inside the candles?

- Retail: Hesitant to buy up here. Most got shaken out at $170 or are anchored to $230 highs.

- Institutions: Quietly accumulating. Look at volume behavior—less chasing, more absorbing.

- Shorts: Trapped above $215. Every test of that level squeezes them tighter.

Greed hasn’t shown up yet. That’s your edge.

Short-Term Forecast (3–5 Days)

Here’s the honest call:

If AAPL breaks $215.60 with volume

- Expect a push to $220, possibly $222.80

- RSI may breach 70 → expect brief cooling after

If AAPL fails again and breaks $210

- Drop to $204.20 is on deck

- Then maybe deeper correction to $198.90 support shelf

Most likely? We see a fakeout move early next week—shake weak hands—then the real move triggers.

Final Thoughts: My Personal Take

If I had to bet today? I’d say we’re looking at a coiled breakout. But I’m not blindly long.

I want a daily close above $215.60 with volume. Not a wick. Not an intraday tease. A real candle.

If that shows up, I’m long with a tight stop. If not, I’m sitting on my hands and waiting for the breakdown flush to reset entries around $204.

This is one of those trades where discipline pays. Don’t anticipate. React.

FAQs – Apple Stock Analysis

-

Is Apple stock a buy right now?

Only if it breaks $215.60 with strong volume. Otherwise, it’s stuck in a tight range.

-

What are Apple’s key support and resistance levels?

Support sits at $210–211 and then $204. Resistance is $215.20 and $220.

-

Will AAPL go up or down next week?

It depends on the breakout. Above $215.60 = up. Below $210 = likely correction.

-

What indicators show Apple’s momentum?

RSI at 67 = strong, nearing overbought

MACD = still bullish but momentum slowing

Price above 50/200 MAs = long-term strength -

Is it safe to swing trade AAPL this week?

Yes, with defined risk. Use the $215.60 breakout or $209.80 breakdown as your trigger.

Final Word to Traders

Apple’s not a meme stock. It’s a machine. But even machines stall sometimes. Right now, we’re in pre-move territory don’t force the trade.

Set your alerts. Prep your levels. And when the move comes move with it, not before it.

Want more of these breakdowns? Drop me the next chart. Let’s trade smart.