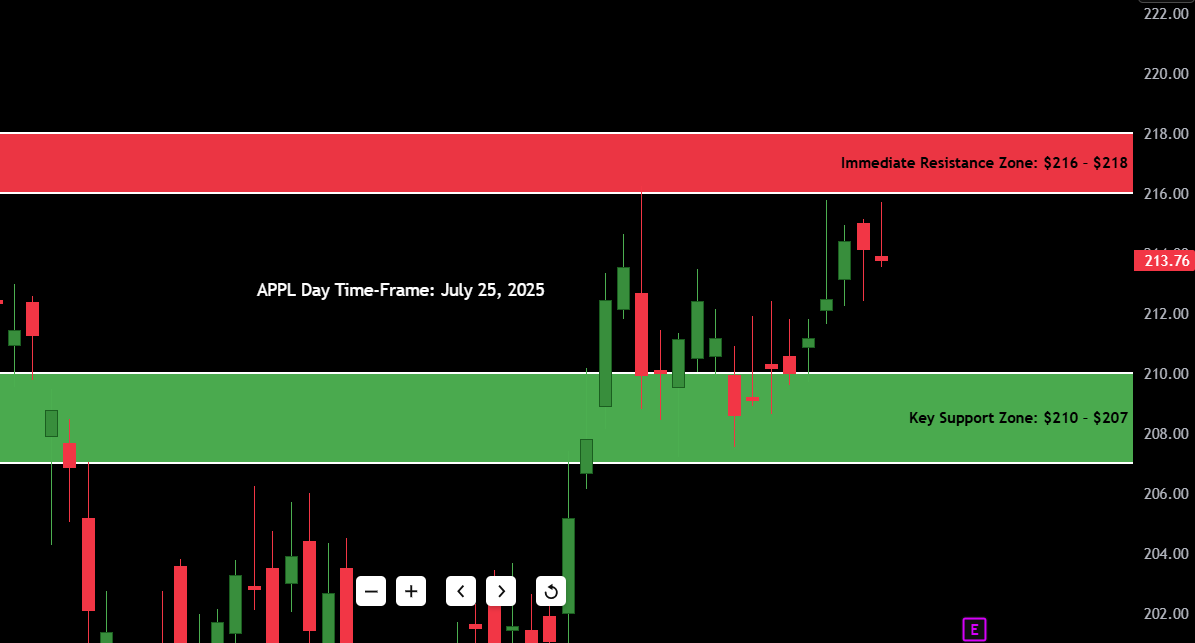

As of July 25, 2025, Apple Inc. (AAPL) is trading at $213.76, marking a minor pullback of 0.18% on the day. The stock reached a session high of $215.69 and a low of $213.53, showing tight range-bound behavior after a recent bullish stretch. While the broader trend remains bullish, today’s price action flashed indecision—potentially signaling a pause or pullback before another move.

- AAPL Stock Price Today: $213.76

- 52-Week High / Low: $222.45 / $171.89

- Immediate Resistance Zone: $216 – $218

- Key Support Zone: $210 – $207

- Forecast for July 25: Neutral to mildly bullish

- Short-term Bias: Cautiously Bullish

The stock has climbed nearly 12% from its late-June lows and is just 3.9% away from its 52-week high. But with low-range candles and reduced volume, bulls need to be careful here. A break above $216 could reignite momentum, while a dip below $210 may trigger stop runs.

Contents

Candlestick Chart Analysis

AAPL’s recent candlestick structure reflects a slow-grinding uptrend, but today’s candle closed with a small-bodied doji—a classic sign of hesitation near resistance. Here’s what traders should note:

- The current trend remains upward, but candles have become smaller and less impulsive.

- After a strong run-up in early July, we’ve now entered a range-bound chop between $211 and $215, forming a rising wedge structure.

- Today’s candle (July 25) opened at $213.90 and closed near the low at $213.76, showing minor bearish pressure.

- The pattern over the last 4 sessions resembles a “grind to resistance” setup—often seen before either a breakout or a rug-pull reversal.

No volume is visible on the chart, but judging from price behavior, the momentum has clearly slowed.

Key Pattern:

We may be seeing the early signs of a local double top forming around $215.60–$216.00. If price rejects that level again, expect a flush toward $208.

Microstructure Note:

If AAPL breaks above $216.00 with authority and volume, it could target the $220+ zone quickly. However, any fakeout wick above $216 followed by a rejection could trap breakout buyers—something to avoid.

AAPL Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $216.00 | Recent swing high & double top zone |

| Resistance 2 | $218.25 | Breakout trigger zone |

| Resistance 3 | $222.45 | 52-week high |

| Resistance 4 | $225.00 | Psychological round number |

| Support 1 | $210.00 | Daily demand zone |

| Support 2 | $207.50 | Consolidation base before breakout |

| Support 3 | $202.80 | Last major low |

| Support 4 | $171.89 | 52-week low |

$216.00 remains the most important resistance, while $210.00 is critical support for short-term bulls.

7-Day Price Forecast Table

| Date | High | Low | Expected Close |

|---|---|---|---|

| Day 1 | $215.80 | $212.00 | $214.50 |

| Day 2 | $216.50 | $211.80 | $215.10 |

| Day 3 | $217.20 | $210.50 | $213.90 |

| Day 4 | $218.80 | $212.90 | $217.00 |

| Day 5 | $219.00 | $215.00 | $218.30 |

| Day 6 | $220.40 | $216.00 | $219.00 |

| Day 7 | $222.00 | $217.50 | $220.20 |

Forecast Logic:

If $210 support holds, bulls may gradually push AAPL toward $220–$222 over the next week. However, this setup is fragile. A close below $210 would invalidate the pattern and send the stock into a cool-off correction toward $202.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $216.00 | Breakout confirmed with momentum |

| HOLD | Range between $210–$215 | Low volatility, neutral zone |

| SELL | Break below $210.00 | Breakdown from support |

Right now, HOLD is the safest position unless you’re day-trading. If AAPL decisively clears $216, a BUY makes sense with a stop at $210. Risk-reward is solid on a confirmed breakout, but patience is key.

A SELL below $210 is warranted for swing traders looking to short weakness, especially if volume spikes and confirms the breakdown.

Fundamental Triggers

Here are the macro and micro triggers that could impact AAPL’s stock price in the coming sessions:

Upcoming Earnings Report

Apple is expected to report Q3 2025 earnings within the next two weeks. With the tech sector recently outperforming, expectations are high. A strong earnings beat could be the catalyst for a breakout above $220.

Sector Rotation

Investors have rotated back into mega-cap tech stocks like Apple and Microsoft after mixed inflation data and falling bond yields. This macro backdrop supports the uptrend.

Federal Reserve & Inflation Data

Next week’s PCE inflation data and comments from Jerome Powell could shake markets. If inflation remains sticky, rate-cut hopes may fade, pressuring growth stocks like Apple.

Analyst Coverage

Multiple analysts have maintained a “Buy” rating on AAPL with an average target price of $238–$245. Any upgrades or raised forecasts could boost momentum.

Institutional Accumulation

While we don’t have visibility into block orders from this chart, the steady stair-step rise in July hints that institutions may be quietly accumulating under the radar.

Final Thoughts

From a trader’s lens, AAPL is at a crucial make-or-break point. The stock has enjoyed a nice run from $192 to $215, but now it’s bumping up against stiff resistance with reduced momentum.

- Bullish Outlook: If price breaks and holds above $216.00, the next targets are $220.50 → $222.45 (52-week high). The setup favors continuation if bulls stay in control.

- Bearish Risk: A breakdown below $210.00 could spark a deeper flush toward $202.50 or even $198.00, especially if earnings disappoint or macro headwinds intensify.

Key Trading Insight:

In my experience, grind-up rallies into resistance with weak candles often trap breakout buyers. If we see price spike above $216 and quickly fall back, that’s a red flag. Watch how volume behaves—if it’s thin on the breakout, it’s likely a fakeout. In that case, I’ll personally be looking to short weakness toward $208.

For now, patience is key. Let price show its hand at $216. If the bulls are real, we’ll see an explosive breakout. If not, step aside and wait for better entries near $210 or lower.

If you’re a swing trader or investor looking at AAPL stock forecast this week, stay nimble and alert. Momentum is real—but so are traps. The levels are clean. The setup is clear. Trade it smart.