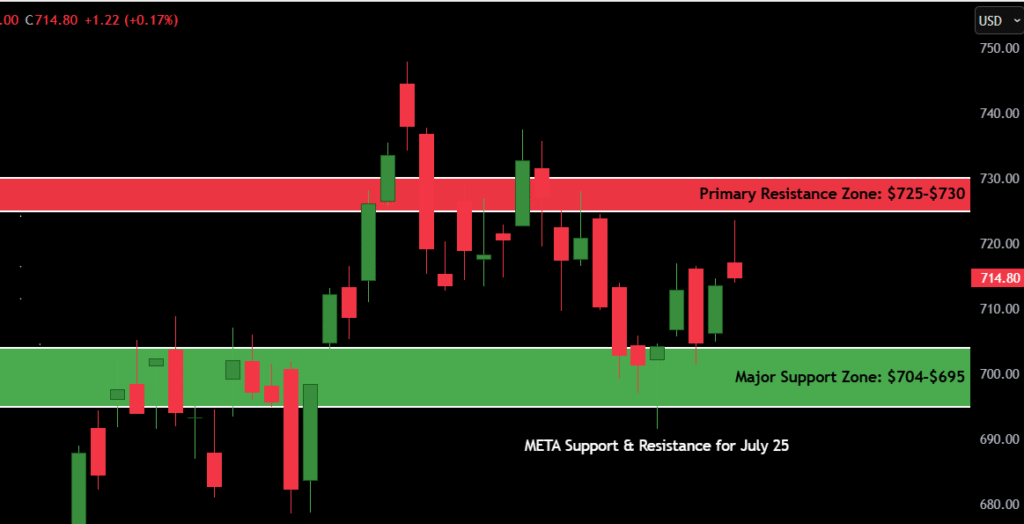

Meta Platforms (META) closed today at $714.80, showing slight green on the day with a +0.17% gain. Price action remains choppy but is stabilizing after last week’s minor breakdown attempt. Today’s META stock forecast leans cautiously bullish, but price sits right at a key reaction zone.

- Current Price: $714.80

- July 25 META Stock Prediction: Neutral-to-bullish bias if price stays above $710

- 52-Week High / Low: $789.10 / $274.38

- Primary Resistance Zone: $725–$730

- Major Support Zone: $704–$695

The candlestick chart suggests Meta is forming a base-building pattern after failing to sustain momentum above $735 earlier this month. If buyers defend this zone with volume, we may see a retest of $725+ in the coming sessions.

Contents

Candlestick Chart Analysis

META has been stuck in a sideways consolidation pattern for most of July. After peaking around $752 in late June, the stock formed a series of lower highs followed by sharp pullbacks. Most recently, the daily chart shows:

- Two bullish candles back-to-back off a near-term bottom around $700, showing buyer interest creeping in again.

- Today’s candle is a narrow-body green candle with upper wick — indicating some intraday selling pressure near $720, but not enough to reverse trend.

- The stock bounced from $695 on July 18, which acted as a liquidity sweep of recent lows — classic false breakdown behavior.

- META is showing a short-term double bottom setup near $695, with potential for upside if buyers defend $710–$714.

Volume has been relatively light, signaling caution among both bulls and bears. If volume returns on a green close above $720+, that could be the confirmation trigger for bulls.

Bias: Neutral with bullish tilt, as long as $710 holds.

Meta Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $725 | Immediate supply zone from July 10 |

| Resistance 2 | $735 | Minor swing high from July 5 |

| Resistance 3 | $752 | Post-breakout rejection |

| Resistance 4 | $789 | 52-week high |

| Support 1 | $710 | Current price floor |

| Support 2 | $704 | Recent bounce zone |

| Support 3 | $695 | Liquidity sweep low (July 18) |

| Support 4 | $652 | Gap-fill support from May |

Key level to watch: $710 is the make-or-break zone. Below that, things could get heavy again. Bulls want to flip $725 next.

7-Day Price Forecast Table

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 26 | $722 | $710 | $718 |

| July 27 | $728 | $714 | $725 |

| July 28 | $733 | $718 | $729 |

| July 29 | $738 | $725 | $735 |

| July 30 | $740 | $728 | $730 |

| July 31 | $728 | $712 | $720 |

| Aug 1 | $735 | $715 | $727 |

Forecast logic:

If META holds above $710, buyers could grind the stock higher toward $730–$735. But a close below $704 would invalidate the short-term bullish thesis and open the door for another dip to $695–$685 range.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $725 | Breakout from current range |

| HOLD | Range between $704–$724 | Chop zone, needs confirmation |

| SELL | Break below $704 | Breakdown of key demand zone |

At this point, META is a HOLD, leaning bullish. There’s no confirmed breakout yet, but bears are also struggling to drive price below $704. If we get a strong close above $725 with increasing volume, a BUY signal will trigger.

If you’re trading short-term, wait for confirmation — don’t chase unless $725 becomes support on a retest.

Fundamental Triggers

Several macro and company-level catalysts could shift META’s trajectory:

- Earnings Alert: Meta is expected to report Q2 earnings in early August. Traders will be watching for AI segment growth, Reels monetization, and VR/AR division updates.

- Fed Watch: With a potential Fed rate hold looming in late July, tech stocks could benefit from a dovish outlook.

- Social Media Sector Trends: Snap and Pinterest have underperformed; if Meta shows divergence in ad revenue growth, it could attract flows.

- Short Interest: No signs of aggressive shorting as of now, but watch for options activity near $750.

Overall, Meta’s fundamentals remain strong, but valuation sensitivity in the tech sector remains a wild card if macro shocks resurface.

Final Thoughts

Outlook: Cautiously Bullish

META is showing signs of basing near $695–$710, with early signs of accumulation. This could be the foundation for a late summer move toward $740+, especially if earnings surprise to the upside.

Key zones to watch:

- Above $725 = breakout confirmed

- Below $704 = bearish breakdown

- $714–$710 = the battlefield

In my experience, sideways patterns like this often trap impatient traders, and the real move happens when nobody expects it. If we get a clean close above $725 with volume, I’ll be long targeting $752. But if $704 breaks, I’ll step aside — or even short toward $685.

Keep your stop losses tight and your conviction tighter. META isn’t a race it’s a setup.