Microsoft Corporation Bullish and Bearish Analyst Opinions (2025 Review)

Wondering whether to buy, hold, or sell Microsoft stock in 2025? In this article, we dive deep into Microsoft Corporation bullish and bearish analyst opinions to help you understand both sides of the market. From AI-driven growth projections to regulatory and valuation risks, we break down what top Wall Street experts are saying about MSFT right now.

Contents

Key Points

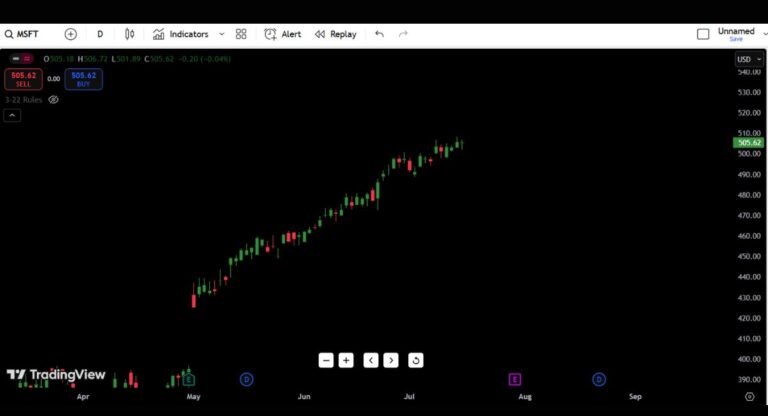

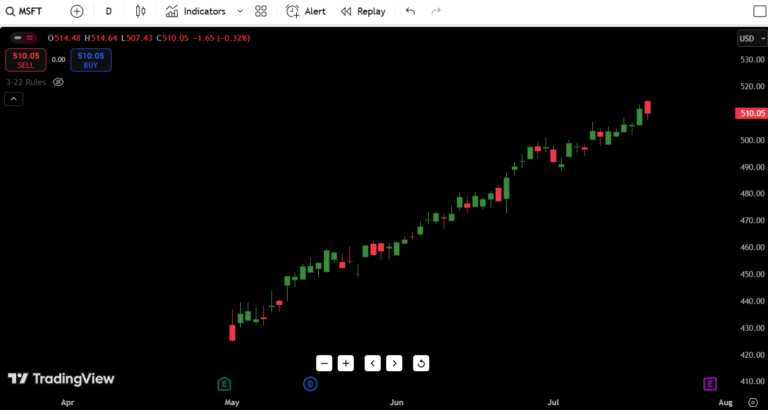

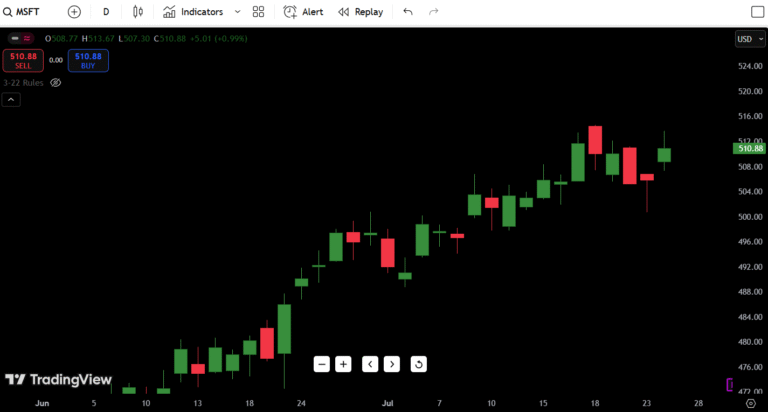

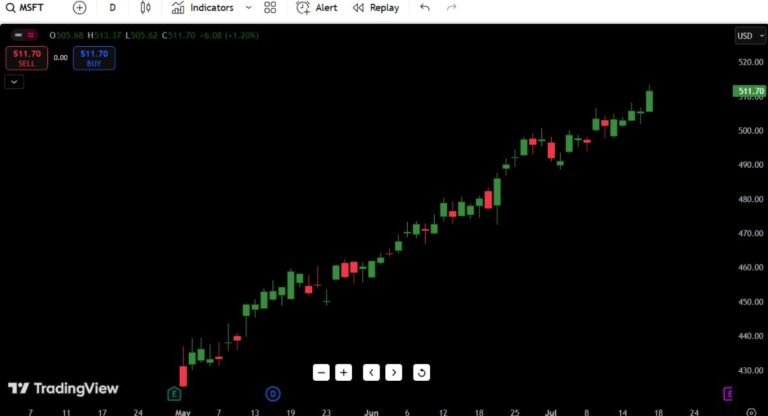

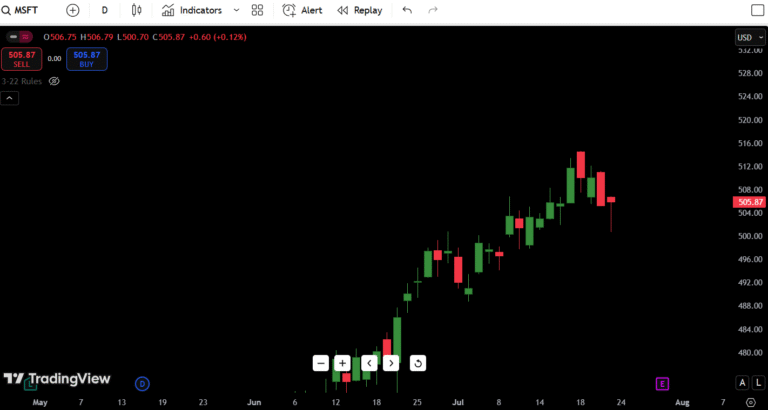

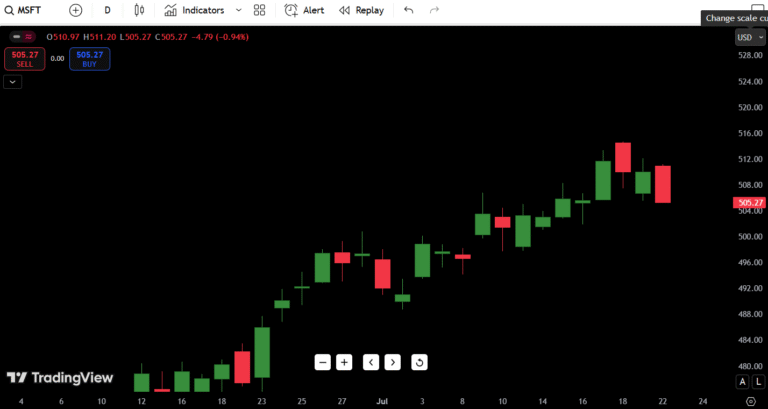

- Trend: Strong bullish momentum with a breakout in progress

- Current Price: $510.06, testing major resistance

- 52-Week High: $514.64 — breakout level

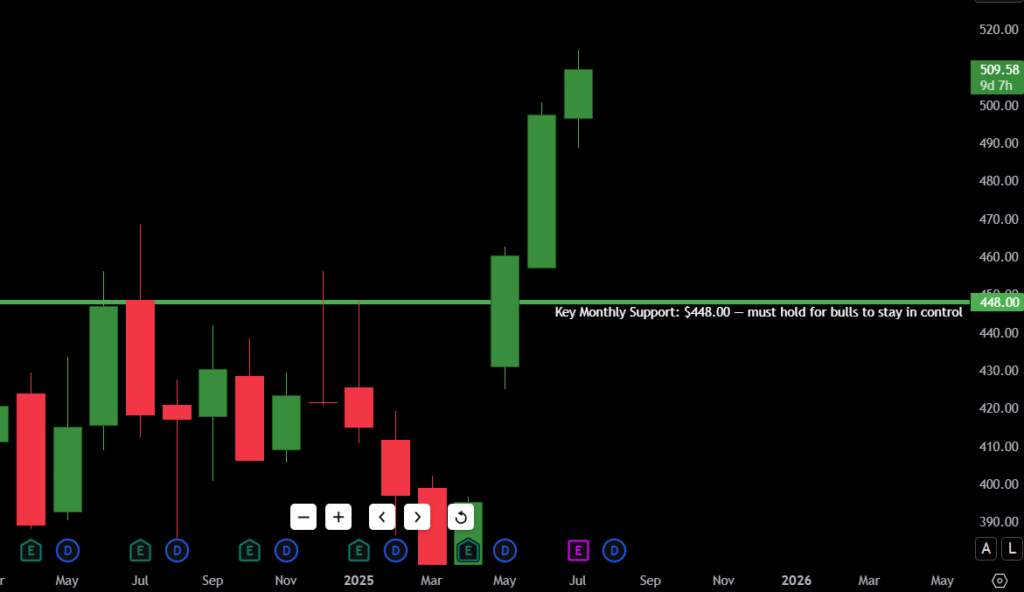

- Key Monthly Support: $448.00 — must hold for bulls to stay in control

- Bias: Bullish, but risk of fakeout if price stalls below $515

- Candle Behavior: Large green body — strong buyer interest

- Watch Zone: $488–$514 range for confirmation or rejection

- Possible Targets: $530, $560, $586 on successful breakout

- Bearish Scenario: Break below $448 = trend reversal risk

Also Read: Best Stocks to Buy in 2025

MSFT Monthly Support and Resistance Levels

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $514.64 | All-time high (ATH) |

| Resistance 2 | $530.00 | Round number breakout extension |

| Resistance 3 | $560.00 | Measured move target |

| Resistance 4 | $586.00 | Fib 1.618 extension zone |

| Support 1 | $448.00 | Key breakout level & prior high |

| Support 2 | $420.00 | Consolidation support |

| Support 3 | $382.50 | Major swing low zone |

| Support 4 | $311.89 | 52-week low |

Most Important Zones:

- $514.64 → Break and hold = strong bullish confirmation

- $448.00 → Break below = bearish shift begins

30-Day (Monthly) Price Forecast – August 2025

| Week | High | Low | Expected Close |

|---|---|---|---|

| Week 1 | $520 | $495 | $510 |

| Week 2 | $530 | $505 | $525 |

| Week 3 | $538 | $510 | $532 |

| Week 4 | $545 | $518 | $538 |

Forecast Logic:

If MSFT maintains structure above $495, price could grind upward toward $530–$545 over the month. The bullish thesis remains valid as long as $488–$495 holds. A close below that range may invalidate the move and trigger a correction back to $470–$448.

Fundamental Triggers

While this analysis is primarily technical, several upcoming events could influence MSFT stock price:

- Q2 2025 Earnings Report: Expected in late July or early August. Watch for cloud growth, AI integration commentary, and Azure revenue trends.

- Federal Reserve Rate Policy: Any hawkish shift could weigh on tech stocks like Microsoft, which have benefited from lower discount rates.

- AI Market Sentiment: Microsoft’s heavy investment in OpenAI and Copilot has been a bullish driver. Any change in public or enterprise AI adoption could affect sentiment.

- Analyst Upgrades/Downgrades: Expect institutional re-ratings if MSFT closes at ATHs.

- Tech Sector Rotation: If semiconductors or small-cap tech weakens, funds may rotate back into mega-cap safe havens like Microsoft.

Final Thoughts

From a monthly timeframe, Microsoft Corporation (MSFT) remains one of the cleanest long setups in the market.

- Outlook: Cautiously Bullish

- Bullish Confirmation: Monthly close above $514.64

- Bearish Trigger: Monthly close below $448.00

- Watch Zone: $488–$514 – expect some volatility here

Trader Insight:

“In my experience, monthly breakouts at all-time highs are powerful — but only if they’re backed by volume and not driven by short-term euphoria. If MSFT holds above $500 and builds a new base, this could just be the beginning of a larger move into the $530–$560 zone. But if this candle closes with a long wick or bearish rejection, we may be looking at a bull trap — and I’d watch $470 and $448 closely.”

FAQ’s

-

Why are some analysts bullish on Microsoft right now?

Simple Microsoft’s firing on all cylinders. Their cloud business (Azure) is still growing like crazy, they’re deep in the AI game with OpenAI, and they’ve got a rock-solid balance sheet. Analysts love that combo of innovation and stability. If you’re thinking long term, a lot of folks see MSFT as a no-brainer.

-

What are the bearish analysts worried about?

The main gripe? Valuation. Microsoft’s stock isn’t exactly cheap right now, and some analysts think it’s priced for perfection. There’s also the usual regulatory pressure and fears that big enterprise spending might slow down. So if growth stalls even a little, it could get hit short-term.

-

Are analysts mostly saying buy, sell, or hold?

Most of them are still in the “Buy” camp — some even “Strong Buy.” But they’re also saying don’t expect a rocket ship every quarter. It’s more of a steady-growth, blue-chip play unless something big shakes the tech space. So yeah, still bullish, just maybe with a bit of caution baked in.

-

Can analyst opinions really move Microsoft’s stock?

Absolutely. When a big-name firm like Morgan Stanley or Goldman throws out a new price target, the stock can jump — or drop — fast. Especially if it happens around earnings. So yeah, these opinions matter, even if they don’t always get it right.

-

Where’s the best place to find these bullish and bearish calls?

Honestly, places like Yahoo Finance, CNBC, or Bloomberg are solid. If you want more commentary, check out Seeking Alpha or even Reddit’s r/stocks. A lot of traders also just track what the big banks are saying — JPMorgan, Barclays, you name it. Just make sure you’re getting the full picture, not just the hype.