NVIDIA (NVDA) Stock Analysis – July 22, 2025

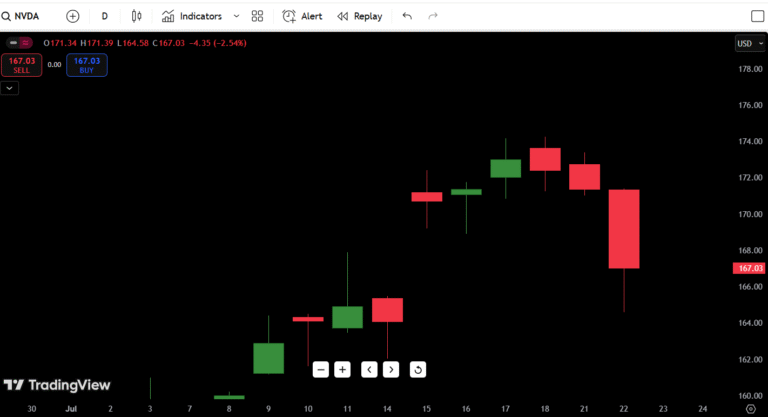

As of today, NVIDIA (NVDA) stock is trading at $172.73, up +0.19% for the session. The stock has been on a powerful multi-week uptrend, but is now stalling just beneath recent highs, printing small-bodied candles into resistance. Momentum looks strong—but caution is rising after this extended leg.

- Current Price: $172.73

- Daily Direction: Bullish but losing momentum

- 52-Week High: $184.00

- 52-Week Low: $116.00

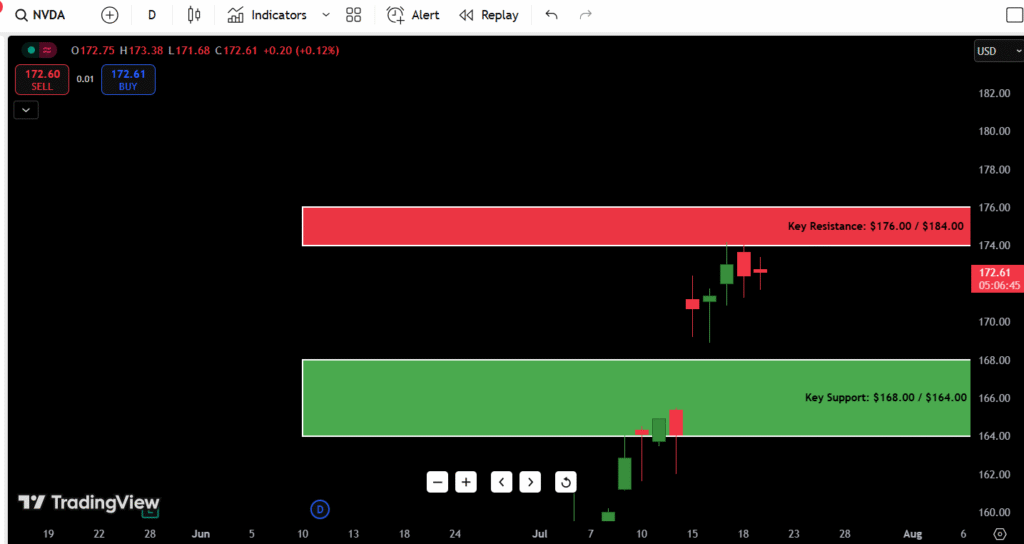

- Key Support: $168.00 / $164.00

- Key Resistance: $176.00 / $184.00 (52-week high)

Observation for July 22:

NVIDIA is flagging beneath key resistance at $176–$178. If bulls can’t break out soon, this rally risks rolling over into a healthy pullback toward $164–$168. But any strong volume push through highs could ignite another breakout run.

Contents

- Candlestick Chart Analysis for July 22 Outlook

- Trend Overview:

- Recent Candlestick Behavior:

- Market Structure:

- Volume Profile (Visual Assessment):

- Support and Resistance Levels Table

- 7-Day Price Forecast Table (July 22 Start)

- Buy, Hold, or Sell Decision Table

- Current Bias:

- Fundamental Triggers to Watch

- Final Thoughts for July 22, 2025

- Outlook: Neutral to Slightly Bullish IF $176 Breaks

- What I’d Do As a Trader:

Candlestick Chart Analysis for July 22 Outlook

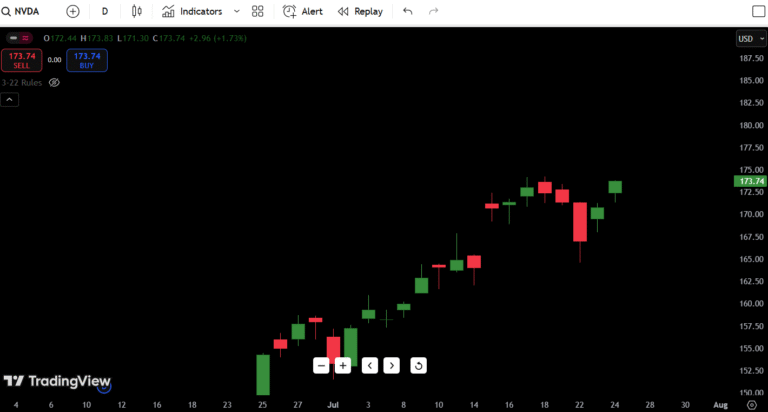

Trend Overview:

NVIDIA remains in a strong uptrend off its early June lows near $140. Price action has been clean, stair-stepping higher with healthy pullbacks. But the current candles show tightening ranges—a classic pause or flag pattern.

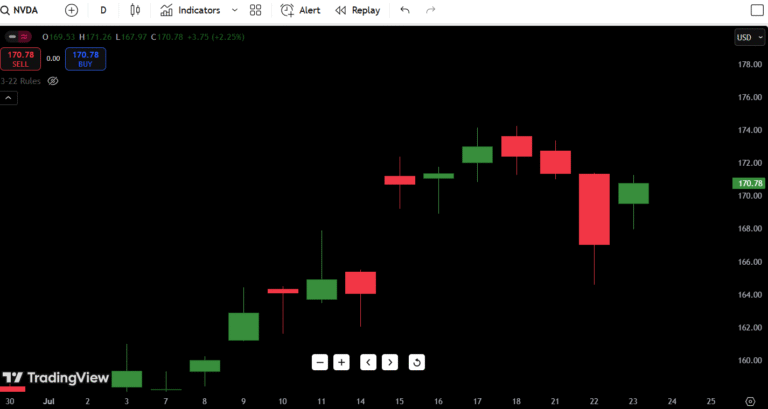

Recent Candlestick Behavior:

- Small-bodied candles near recent highs show hesitation.

- Minor rejection wicks suggest some sellers defending $175+.

- Today’s candle is a neutral inside bar—buyers aren’t aggressive, but sellers aren’t dominant either.

Market Structure:

- Short-Term: Uptrend slowing, possible bull flag forming.

- Macro: Still strong, but running hot after a sharp climb.

- Critical zone: $176–$178 breakout OR breakdown back to $164.

Volume Profile (Visual Assessment):

- Volume declining the past 4 sessions—classic pre-breakout OR exhaustion signal.

- Watch for volume spike confirmation before trusting any breakout.

Summary: If NVDA doesn’t clear $176–$178 soon with volume, we likely see a controlled fade toward $164–$168 support. Above $178? Next stop is likely $184 retest.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $176.00 | Current short-term ceiling |

| Resistance 2 | $178.00 | Minor breakout trigger |

| Resistance 3 | $184.00 | 52-week high |

| Resistance 4 | $190.00 | Round number / future target zone |

| Support 1 | $168.00 | Nearest recent demand zone |

| Support 2 | $164.00 | Recent breakout retest area |

| Support 3 | $155.00 | Prior consolidation zone |

| Support 4 | $140.00 | Previous major low |

Key Level: $176 breakout or $168 failure will dictate NVDA’s next move.

7-Day Price Forecast Table (July 22 Start)

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 22 | $176 | $170 | $172 |

| July 23 | $178 | $172 | $175 |

| July 24 | $180 | $174 | $178 |

| July 25 | $184 | $178 | $182 |

| July 26 | $182 | $175 | $178 |

| July 27 | $176 | $168 | $172 |

| July 28 | $170 | $164 | $168 |

Forecast Logic:

If NVDA breaks $176–$178 early this week, bulls likely push toward $182–$184 quickly. If it stalls or reverses, expect a pullback to $168–$164 for a healthy consolidation.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Break above $178 | Momentum breakout confirmed |

| HOLD | Range-bound $168–$176 | Healthy digestion, trend intact |

| SELL | Break below $168 | Momentum stalling, pullback begins |

Current Bias:

Hold if long, wait for breakout confirmation to add.

At this stage, NVDA looks extended but not broken. Chasing here without a breakout over $176–$178 is risky; better trade location comes either on strength through highs, or a healthy dip toward $164.

Fundamental Triggers to Watch

- Earnings Season: NVIDIA’s next earnings report is weeks away but will loom large.

- AI Sector Sentiment: NVDA remains a bellwether for AI; any weakness in AI peers could drag sentiment.

- Macro Tech Flows: NVDA tracks closely with QQQ, SOXX, SMH ETFs. Tech-wide corrections could ripple.

- Fed Outlook: Any surprising Fed comments on rates could trigger volatility in high-beta names like NVDA.

- Upgrades/Downgrades: Analysts remain bullish, but downgrades here would sting more after this big run.

Final Thoughts for July 22, 2025

Outlook: Neutral to Slightly Bullish IF $176 Breaks

This is a classic “pause at highs” setup. Either NVDA breaks $176–$178 and trends higher toward $184+, or we get a clean fade back to $168–$164 for rebalancing.

Watch these zones:

- Breakout Zone: $176–$178

- Pullback Support: $168–$164

What I’d Do As a Trader:

- Not buying the highs unless we break $178 on volume.

- Would prefer dip buys near $164–$168 where risk/reward is more favorable.

- If we see a weak breakout attempt fail? Fade short back to $168 support.

In my experience, extended runs like this into resistance zones often trap late buyers if volume doesn’t confirm. Patience beats FOMO at highs.