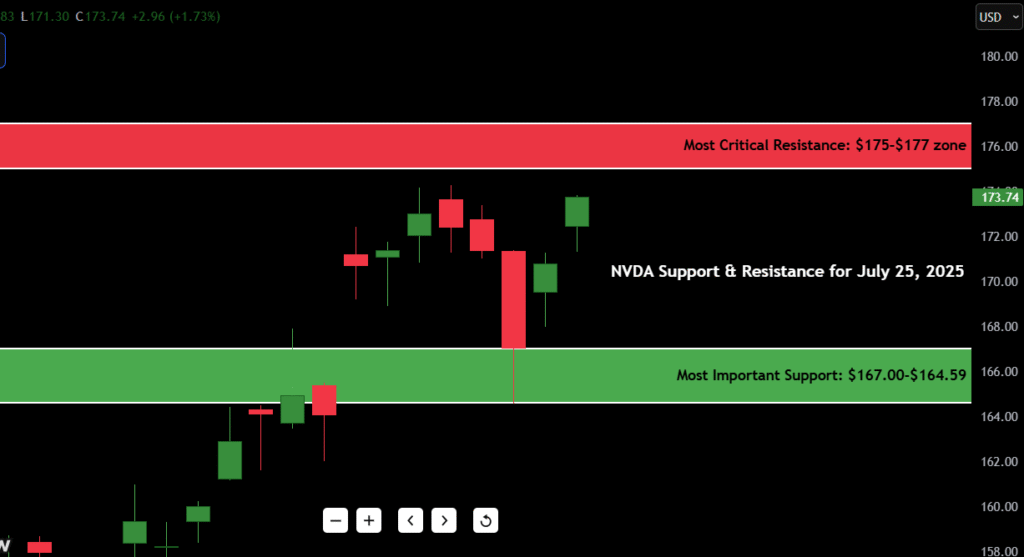

As of July 25, 2025, NVIDIA Corp. (NVDA) is trading at $173.74, closing the day up +1.73% after rallying from an intraday low of $171.30. This continues a multi-week uptrend, as NVDA pushes back toward local highs, following a textbook bounce off key demand near $167.

- Current Price: $173.74

- Daily Direction: Bullish

- 52-Week High: $187.44

- 52-Week Low: $119.21

- Most Critical Resistance: $175–$177 zone

- Most Important Support: $167.00–$164.59

Today’s price action adds conviction to the bullish continuation thesis. The dip from earlier this week was aggressively bought, and buyers are now pressing into a potential breakout zone. All eyes are on $175 can NVDA finally clear and hold that range?

Contents

Candlestick Chart Analysis – NVDA Setting Up for a Bullish Break?

Looking at the NVDA candlestick chart, we’ve got a classic bullish staircase forming. After a brief pullback into $167, today’s session confirms buyers are still in control.

Let’s break it down like a trader:

- Trend: NVDA remains in a strong uptrend, with clean higher highs and higher lows since late June.

- Candle structure: Today’s candle is a bullish engulfing bar, completely taking out yesterday’s small red bar and closing strong near the high of the day.

- Volume context: The last major red bar (July 22) was followed by lower-volume selling — then today’s green candle stepped in with better relative volume, indicating bulls bought the dip with confidence.

- Momentum: The price is stair-stepping above prior resistance at $168, now acting as support — a clear bullish market structure.

- Chart pattern: The current setup resembles a bull flag breakout. After a steep run in early July, NVDA has digested that move and is now tightening into another breakout coil.

If price clears $175–$177 with conviction and volume, that opens the door toward a retest of the 52-week high at $187.44.

NVDA Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $175.00 | Near-term breakout zone |

| Resistance 2 | $177.50 | Local high from mid-July |

| Resistance 3 | $183.00 | Minor gap resistance |

| Resistance 4 | $187.44 | 52-week high |

| Support 1 | $167.00 | Strong demand from last pullback |

| Support 2 | $162.50 | June resistance turned support |

| Support 3 | $158.00 | Bullish trendline confluence |

| Support 4 | $119.21 | 52-week low |

The $175 resistance is the immediate battlefield. If bulls push above and hold, momentum traders may pile in. But a rejection here could spark a healthy retest back to $167–$165.

7-Day Price Forecast Table

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 26 | $175.80 | $170.50 | $174.00 |

| July 27 | $178.00 | $172.30 | $176.50 |

| July 28 | $180.00 | $175.20 | $178.20 |

| July 29 | $183.00 | $176.50 | $181.00 |

| July 30 | $185.00 | $179.50 | $183.00 |

| July 31 | $187.00 | $181.50 | $185.00 |

| Aug 1 | $190.00 | $183.50 | $188.00 |

Forecast logic: If NVDA can close above $175 with momentum, there’s a clear runway to grind higher into the $180s. The chart is clean, structure is bullish, and volume supports continuation. However, a failure to hold $172 could send price back to test the $167 zone.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $175.00 | Breakout above resistance with volume |

| HOLD | Range between $167–$175 | Bullish chop zone with breakout potential |

| SELL | Break below $167.00 | Breakdown from demand zone and trend support |

At this point, NVDA is a “Buy on breakout” or “Hold through consolidation”. As long as price holds above $167, the uptrend remains intact. Traders looking to enter should wait for a clean break of $175 with volume confirmation, otherwise risk walking into a fakeout.

If the stock chops between $168 and $175, that’s perfectly healthy basing — but a break below $167 would invalidate the near-term bull setup and shift momentum to the downside.

Fundamental Triggers – What’s Behind the Move

NVDA’s technical strength is backed by a compelling fundamental story, making this more than just a chart trade.

Here’s what’s in play:

- AI & Data Center Growth: NVIDIA remains the core AI infrastructure bet, with massive demand for its H100 and Grace Hopper chips.

- Upcoming Earnings (August): Traders are already positioning for a blowout quarter. Last quarter saw EPS beat by 14%, and guidance raised.

- GPU Supply Chain Strength: With global supply chains stabilizing, NVIDIA has fewer headwinds compared to competitors.

- Sector Tailwind: Semis (SMH) are strong across the board, giving NVDA added momentum.

- Institutional Accumulation: Fund flow data shows consistent institutional buying over the last 30 days — another bullish sign.

Fundamentally, NVDA still leads the AI chip pack. That backdrop makes every technical breakout more likely to hold than fade.

Final Thoughts – NVDA Stock Forecast and Trader’s Outlook

Right now, NVDA is in a powerful uptrend, digesting recent gains and looking ready to push higher. Today’s close at $173.74, up +1.73%, is a clear vote of confidence from bulls after a brief dip.

What to watch from here:

- $175 is the breakout line. That’s the level every trader should have marked on their chart.

- If price breaks and holds above $175, we could see a measured move toward $183–$187.

- If price fails at resistance, look for a potential reload opportunity near $167.

My personal take as a trader: These are the types of setups I love — strong uptrend, shallow pullbacks, tight structure. I’m watching for either a breakout trade above $175 with a stop under $171, or a pullback to $167 for a lower-risk entry. But if $167 fails, I’ll step aside — no reason to fight the tape.

Outlook: Bullish

Breakout Level: $175

Key Risk Zone: Below $167

Trade Plan: Buy the breakout with confirmation, or buy the dip at $167–$169