Tesla (TSLA) Stock Analysis – July 22, 2025

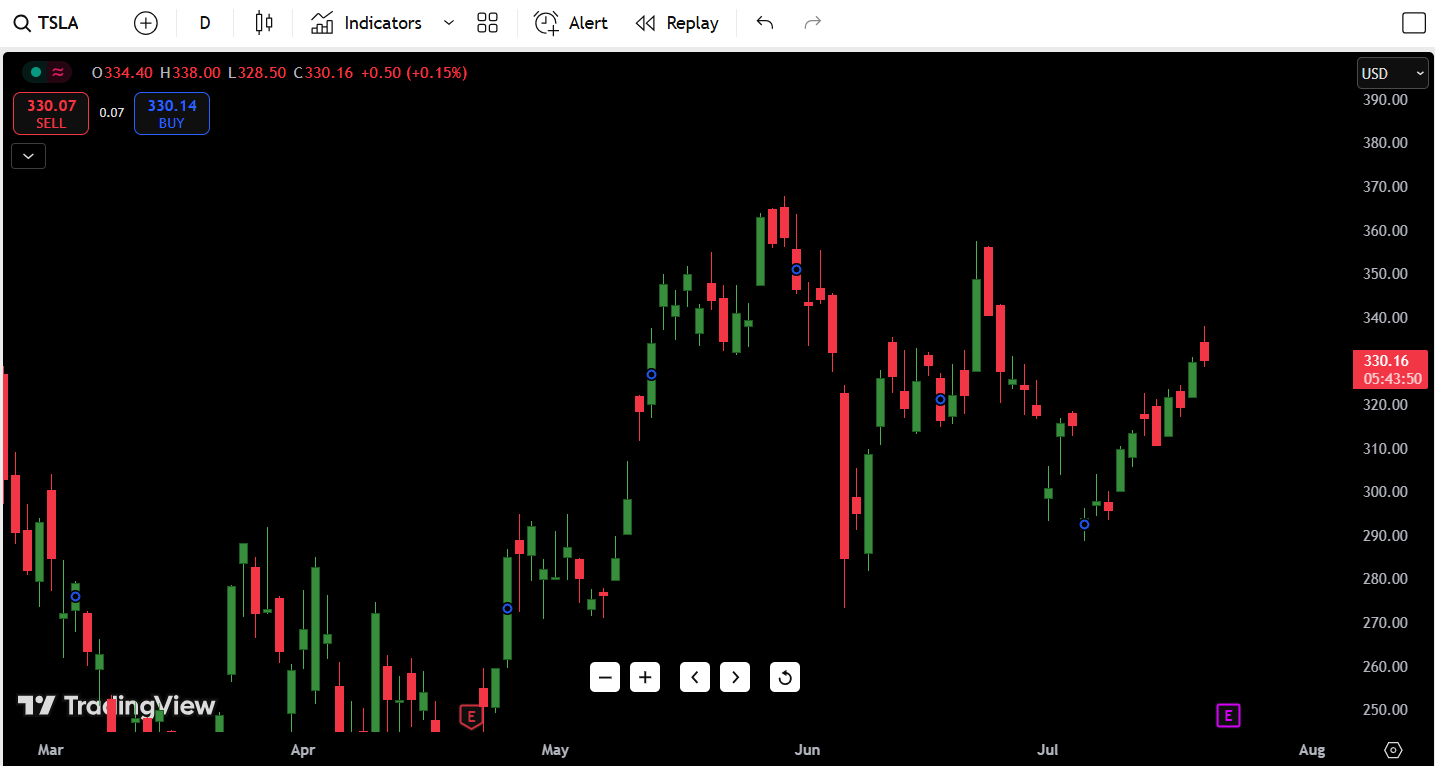

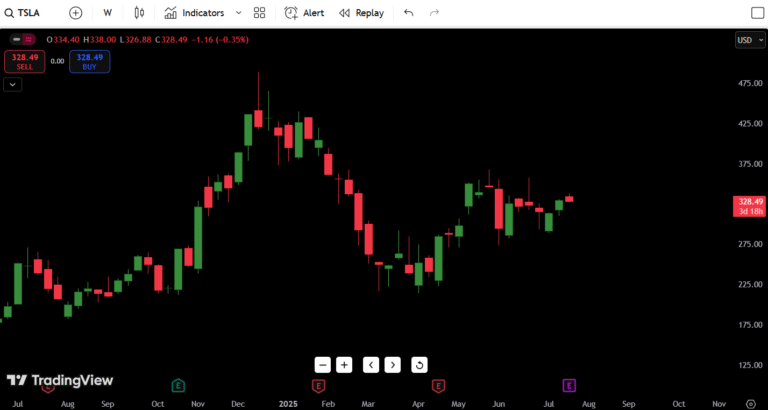

Heading into July 22, 2025, Tesla (TSLA) is closing today at $330.16, printing a relatively flat session with minor gains of +0.15%. The stock remains in an indecisive, choppy range under key resistance at $340.00 as bulls attempt to push higher off the July lows.

- Current Price: $330.16

- Short-Term Direction: Neutral to Slightly Bullish

- 52-Week High: $387.20

- 52-Week Low: $252.30

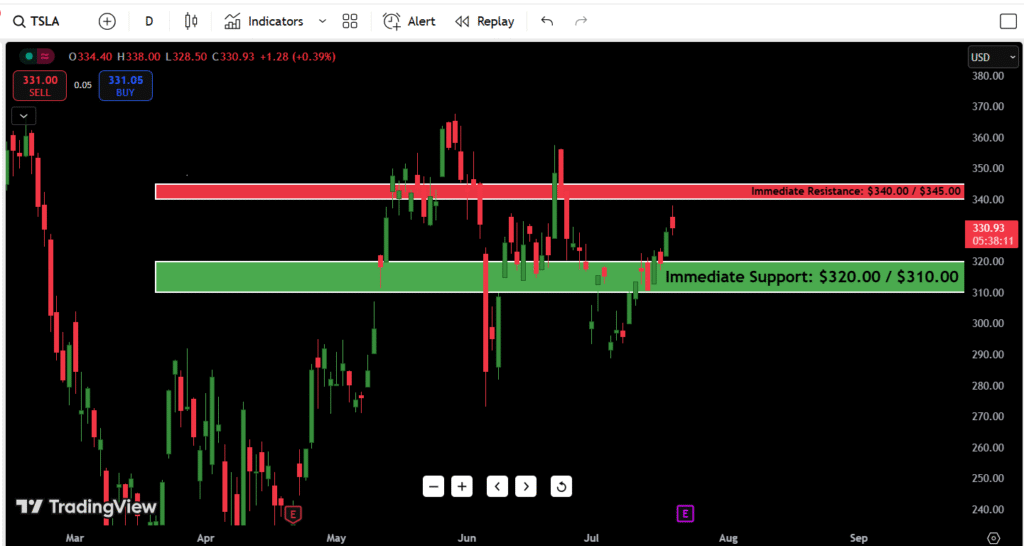

- Immediate Support: $320.00 / $310.00

- Immediate Resistance: $340.00 / $345.00

Key Observation: The tape looks tired heading into tomorrow. Volume is light, price action is compressing, and Tesla is pressing directly into a known sell zone near $338–$340. Without a clear breakout, this could trigger a minor fade.

Contents

- Candlestick Chart Analysis for July 22 Outlook

- What the Chart Says:

- Support and Resistance Levels Table

- 7-Day Price Forecast Table (Adjusted for Tomorrow’s Start)

- Buy, Hold, or Sell Decision Table for July 22

- Fundamental Triggers to Watch Tomorrow

- Final Thoughts for July 22, 2025

- Outlook for Tomorrow: Cautiously Neutral

- What I’ll Be Watching as a Trader:

Candlestick Chart Analysis for July 22 Outlook

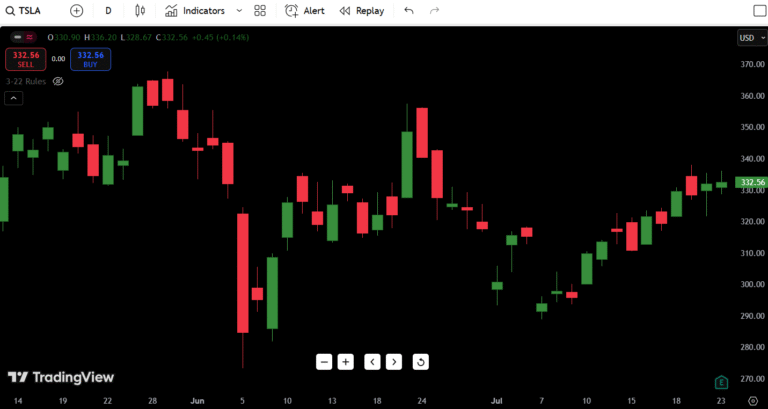

The Tesla candlestick chart remains in a fragile recovery structure off the late June $280 lows, but momentum is noticeably fading as the stock presses into overhead resistance.

What the Chart Says:

- Tesla’s recent rally shows higher lows but no meaningful breakout.

- Today’s candle is small-bodied with rejection wicks—classic indecision near resistance.

- The $338–$340 zone continues to act as a magnet but also a ceiling.

Tomorrow’s Setup (July 22, 2025):

- If TSLA breaks above $340 early with volume, momentum buyers could push toward $345–$350.

- If it rejects early from $338–$340, we likely see a fade back toward $325–$320.

- Watch the opening 30-min range closely for confirmation.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $340.00 | Current key ceiling, psychological |

| Resistance 2 | $345.00 | Recent swing rejection zone |

| Resistance 3 | $355.00 | June breakdown level |

| Resistance 4 | $370.00 | Gap-fill level |

| Support 1 | $320.00 | Recent bounce, demand zone |

| Support 2 | $310.00 | Psychological round number |

| Support 3 | $290.00 | July low |

| Support 4 | $252.30 | 52-week low |

Bold Callout: $340 remains the battleground level for bulls tomorrow.

7-Day Price Forecast Table (Adjusted for Tomorrow’s Start)

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 22 | $340 | $325 | $330 |

| July 23 | $342 | $328 | $334 |

| July 24 | $345 | $330 | $338 |

| July 25 | $348 | $333 | $340 |

| July 26 | $350 | $335 | $342 |

| July 27 | $342 | $328 | $330 |

| July 28 | $335 | $320 | $325 |

Why This Forecast?

Unless Tesla breaks and holds above $340 cleanly, the short-term range remains intact. Any failure near $340–$345 likely leads to a fade back to $320 support.

Buy, Hold, or Sell Decision Table for July 22

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Break and hold above $345 | Clean breakout, targets $355+ |

| HOLD | Range-bound $320–$340 | Choppy structure, no edge |

| SELL | Break below $320 | Breakdown opens risk to $310–$300 |

Trade Plan for Tomorrow:

Watch the open closely at $338–$340. A failed breakout there favors a fade short back to $325. A confirmed breakout above $345 flips bias bullish toward $355–$360.

Fundamental Triggers to Watch Tomorrow

- No earnings scheduled tomorrow, but the stock is likely anticipating its upcoming earnings release next week.

- Broader tech market behavior will heavily influence Tesla (watch QQQ/Nasdaq futures).

- Any fresh headlines on EV market demand, interest rates, or China delivery numbers could shift sentiment intraday.

- TSLA remains sensitive to macro news, especially Fed rate expectations.

Final Thoughts for July 22, 2025

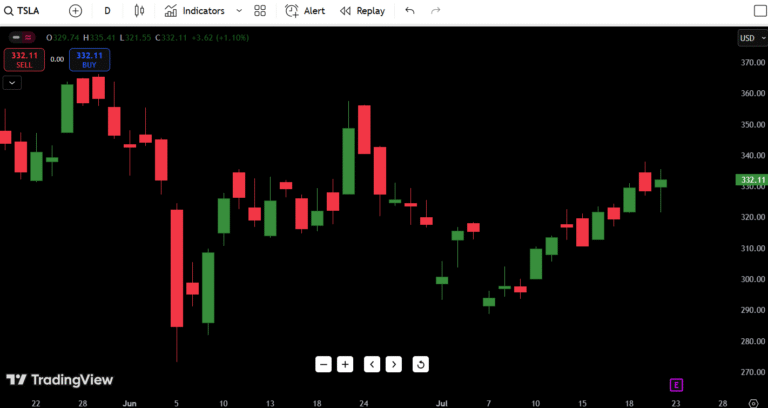

Outlook for Tomorrow: Cautiously Neutral

Bulls are at a critical test here. If they fail to clear $340 cleanly tomorrow, Tesla likely consolidates back toward $325. A breakout sets up for $345+ quickly. Watch volume closely—weak volume breakouts often fail in this range.

What I’ll Be Watching as a Trader:

- Opening hour price action near $340.

- Whether volume confirms any breakout.

- If TSLA fades from $340 again, I’ll be looking for a quick short opportunity targeting $325–$320.

In my experience, Tesla at these mid-range levels often creates traps for both sides before resolving. Patience pays at resistance zones.