As of July 24, Tesla Inc. (TSLA) is trading at $332.56, climbing modestly +0.14% on the day. The stock just closed a hair above a key technical zone and is trying to extend a multi-week uptrend from the $270s.

- Tesla Current Price July 24: $332.56

- Daily Trend: Bullish continuation

- TSLA July 24 Forecast: Cautiously bullish with upside room if momentum holds

- 52-Week High / Low: $384.29 / $194.27

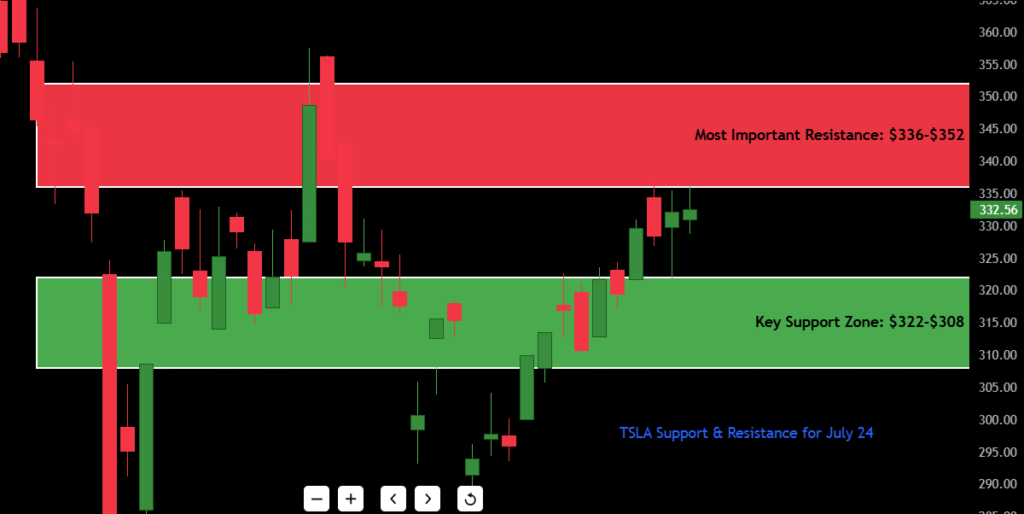

- Most Important Resistance: $336-$352

- Key Support Zone: $322-$308

Critical Setup: TSLA has now put in seven green candles in the last ten sessions, showing steady grind-up behavior. With volume thinning out a bit and price nearing short-term resistance, traders need to watch for either a bullish breakout continuation—or a trap wick and fade back into the range.

- Must Read My Previous TSLA Stock Analysis before Trust

Contents

Candlestick Chart Analysis

TSLA’s chart is showing classic trending behavior, and here’s what stands out technically:

1. Trend:

Tesla is in a short-term uptrend, making higher highs and higher lows since bottoming near $270 in late June. Every minor dip has been bought up—clean trend structure, no sloppiness.

2. Recent Candlestick Behavior:

- Multiple bullish engulfing patterns earlier this month triggered this run-up.

- No exhaustion candles yet—most green candles have small wicks, signaling conviction.

- The latest bar shows a tight-bodied green candle, hinting at indecision after a strong move.

3. Price Action Structure:

- The price has cleared the $320–$324 resistance and is now hovering near the $336 rejection zone from early June.

- No major breakout yet, but a daily close above $336 would set up a run toward $348–$352.

4. Volume & Momentum:

- Volume has decreased slightly during the last 3 sessions. This isn’t bearish yet, but momentum traders should be cautious—momentum without volume is vulnerable to fadeouts.

- RSI is likely approaching overbought territory, but not signaling divergence yet.

5. Fakeouts or Liquidity Grabs?

Watch for a potential fake breakout above $336 followed by a hard reversal. This is a common setup when stocks grind up with declining volume.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $336.00 | Rejection zone from June highs |

| Resistance 2 | $348.75 | Short-term breakout target |

| Resistance 3 | $352.40 | Pre-gap breakdown level |

| Resistance 4 | $384.29 | 52-week high |

| Support 1 | $322.00 | Recent breakout zone |

| Support 2 | $308.00 | Prior accumulation base |

| Support 3 | $295.50 | Bull flag low / minor support |

| Support 4 | $270.80 | Swing low from June bottom |

7-Day Price Forecast Table

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 25 | $336.50 | $327.00 | $333.20 |

| July 26 | $340.80 | $330.10 | $336.90 |

| July 27 | $343.50 | $333.50 | $338.00 |

| July 28 | $348.00 | $336.80 | $346.10 |

| July 29 | $352.40 | $340.00 | $349.20 |

| July 30 | $355.00 | $344.00 | $351.50 |

| July 31 | $360.00 | $348.00 | $358.20 |

Forecast Logic:

If TSLA continues to respect the $322 breakout and builds above $336 with volume, this could turn into a momentum squeeze toward the $350s. However, if bulls get overextended and volume stalls below $336, expect a chop or pullback toward $308 before continuation.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Daily close above $336 | Clean breakout over multi-week resistance with structure |

| HOLD | Range between $322–$336 | Sideways action in consolidation zone |

| SELL | Break below $322 | Failed breakout and trend reversal risk |

Decision Breakdown:

Right now, TSLA is a HOLD to speculative BUY, especially if you’re already long from the $280–$310 range. A break and close above $336 with solid volume is your green light to add or size in further.

But if you’re flat and missed the rally? Don’t chase blindly. Wait for a clean retest of $322 or confirmation that bulls can defend $336 before committing.

Fundamental Triggers

TSLA’s technicals are dominant right now, but fundamentals are never too far behind. Here’s what could impact near-term price action:

- Q2 Earnings Recap: Tesla recently posted earnings, and while margins were under pressure, revenue beat expectations. The street mostly shrugged off concerns.

- EV Sector Rotation: Some EV names are bouncing (RIVN, LCID), creating potential sector sympathy momentum.

- Interest Rates & Fed Talk: If yields soften and the Fed takes a dovish stance, growth stocks like Tesla get tailwind support.

- AI Integration Narrative: Tesla continues to benefit from AI hype due to its autonomous vehicle projects and Dojo supercomputer narrative.

Final Thoughts

Tesla (TSLA) has been grinding higher in a controlled, healthy uptrend, but the stock now sits just under major resistance at $336. This is a decision zone—either we break out cleanly into the mid-$340s and beyond, or we fake out and see profit-taking.

Outlook: Cautiously bullish, but watch for volume confirmation.

Key Levels: $336 resistance to clear. $322 support to hold.

Risk for Bulls: Weak breakout attempts could get slapped back to $308–$312.

Opportunity: Real momentum breakout with trend structure if volume aligns above $336.

Trader Insight:

In my experience, grind-ups into resistance without volume often trap late buyers. If we get a clean pop above $336 and volume spikes, I’ll consider scaling in on the next dip. But if we wick above and fail quickly, I’ll sit tight and let the dust settle—too many breakouts die without confirmation.