Alphabet (GOOGL) Stock Analysis – July 22, 2025

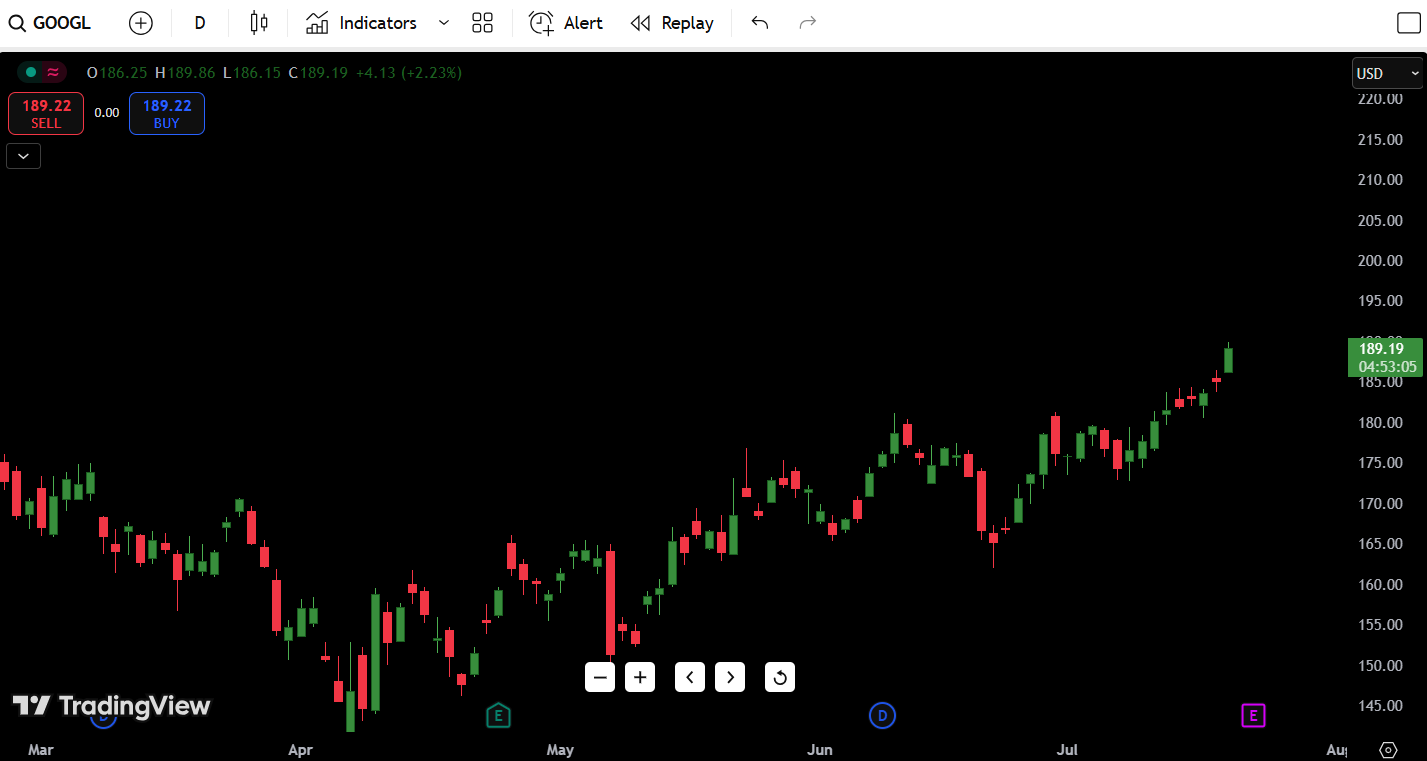

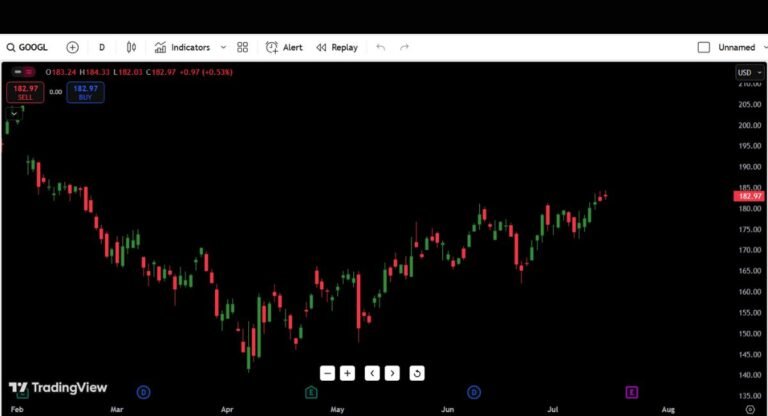

Alphabet Inc. (GOOGL) is showing strong bullish momentum as it breaks to fresh local highs. As of July 22, GOOGL stock is trading at $189.19, up +2.23% today on solid volume. This push higher puts the stock within striking distance of its recent highs and potentially gearing up for a continuation breakout.

- Current Price: $189.19

- Daily Direction: Strong bullish continuation

- 52-Week High: $215.00

- 52-Week Low: $145.00

- Key Support: $185 / $180

- Key Resistance: $190 / $195

Contents

- Observation for July 22:

- Candlestick Chart Analysis for July 22 Outlook

- Trend Overview:

- Recent Candlestick Behavior:

- Market Structure:

- Volume Profile (Visual Assessment):

- Support and Resistance Levels Table

- 7-Day Price Forecast Table (Starting July 22)

- Forecast Logic:

- Buy, Hold, or Sell Decision Table

- Current Bias:

- Fundamental Triggers

- Upcoming Events Impacting GOOGL Stock Forecast:

- Final Thoughts for July 22, 2025

- Outlook: Bullish, with $185 as critical support.

- Critical Zones to Watch:

- My Trading Insight (Trader’s Perspective):

Observation for July 22:

GOOGL is in clear breakout territory after weeks of sideways consolidation under $185. This move today puts bulls in firm control, but overhead resistance clusters between $190–$200 could challenge continuation without strong volume and follow-through.

Candlestick Chart Analysis for July 22 Outlook

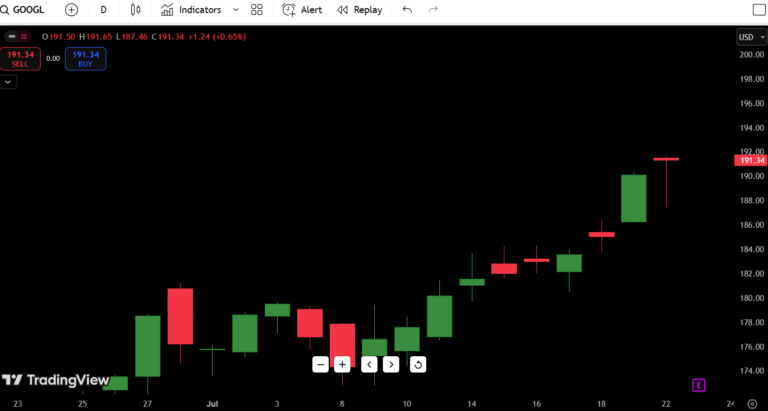

Trend Overview:

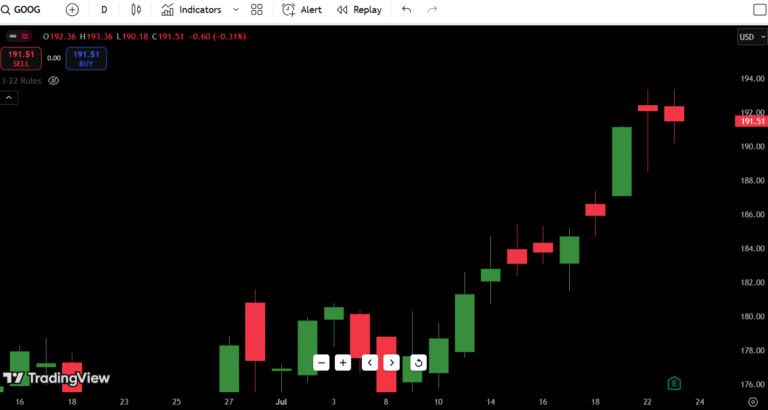

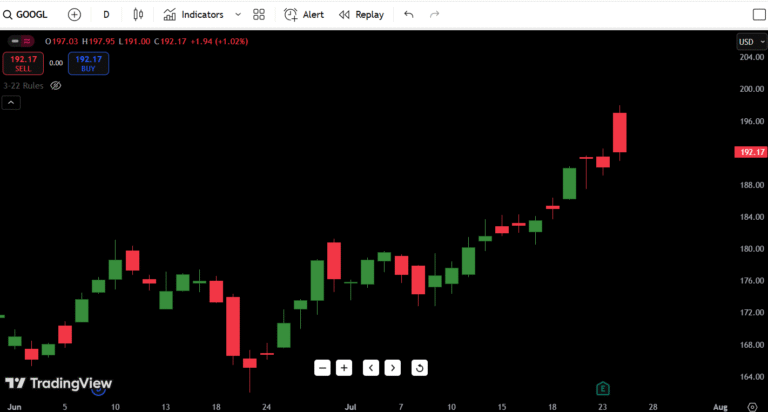

GOOGL has been in a clear uptrend since mid-April, forming a series of higher highs and higher lows, respecting key moving averages. After consolidating sideways through late June and early July, the stock is now breaking out of that consolidation box with authority.

Recent Candlestick Behavior:

- Strong bullish engulfing candle today, pushing through $185 resistance with conviction.

- Previous candles were coiling tight — classic compression before expansion setup.

- Buyers stepped in heavily post-earnings, continuing to defend dips.

Market Structure:

- Short-Term: Strong bullish breakout from range.

- Medium-Term: Approaching upper resistance zones between $190–$200.

- Long-Term: Still intact uptrend aiming at 2023 highs.

Volume Profile (Visual Assessment):

- Volume spiked notably today alongside the breakout — this is institutional behavior and suggests strength behind the move.

- Prior consolidations saw declining volume; today’s breakout reverses that.

Summary: GOOGL is showing textbook breakout behavior. However, breakouts without consolidation retests can risk pullbacks. Bulls need to defend $185–$186 if price tests back.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $190.00 | Current breakout zone |

| Resistance 2 | $195.00 | Next psychological resistance |

| Resistance 3 | $200.00 | Round number magnet / supply zone |

| Resistance 4 | $215.00 | 52-week high |

| Support 1 | $185.00 | Recent breakout base |

| Support 2 | $180.00 | Former range mid-point support |

| Support 3 | $170.00 | Strong prior bounce level |

| Support 4 | $145.00 | 52-week low |

Key Level: $185 must hold for this breakout to remain valid. Any breakdown below opens risk to $180 or lower.

7-Day Price Forecast Table (Starting July 22)

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 22 | $190 | $186 | $189 |

| July 23 | $193 | $188 | $191 |

| July 24 | $195 | $189 | $194 |

| July 25 | $196 | $192 | $195 |

| July 26 | $198 | $190 | $192 |

| July 27 | $200 | $185 | $188 |

| July 28 | $192 | $180 | $183 |

Forecast Logic:

If GOOGL holds above $185–$186 on any pullbacks, the stock likely continues toward $195–$200. However, extended breakouts often need retests — a pullback into $185 is entirely possible. Watch volume: continuation needs strength, not apathy.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $190 | Fresh breakout confirmed |

| HOLD | Range-bound $185–$190 | Consolidating gains, neutral |

| SELL | Break below $185 | Failed breakout, risk of fade |

Current Bias:

Cautious BUY on Breakouts Over $190.

This looks like textbook breakout behavior, but chasing extended candles can be risky. Ideal entries are either early above $190–$191 with tight stops or on pullbacks toward $185.

If GOOGL fades back below $185, that invalidates the breakout thesis short-term.

Fundamental Triggers

Upcoming Events Impacting GOOGL Stock Forecast:

- Earnings Aftermath: Recent earnings beat expectations — continued strength in AI, cloud, and YouTube ad revenue are bullish drivers.

- Sector Sentiment: Tech overall is holding up, but weakness in high-beta names could drag GOOGL.

- Macro: Fed comments this week could trigger volatility across megacap tech.

- AI Narrative: Alphabet’s AI announcements continue to influence sentiment heavily.

- Analyst Price Targets: Upgrades toward $200–$220 targets post-earnings may act as catalysts.

- Institutional Flow: Watch large block prints and option flow — these hint at big money’s true bias.

Final Thoughts for July 22, 2025

Outlook: Bullish, with $185 as critical support.

GOOGL has executed a clean breakout from weeks of consolidation — this is how healthy charts behave. However, traders know not every breakout follows through immediately. If bulls defend $185, the path toward $195–$200 looks clear.

Critical Zones to Watch:

- Immediate Breakout Zone: $190+

- Must-Hold Support: $185

- Risk Zone: Below $180

- Target Magnet: $200 psychological level

My Trading Insight (Trader’s Perspective):

When a big tech name like GOOGL breaks out post-consolidation with volume, respecting the structure matters more than predictions. In my experience, chasing breakouts works IF volume confirms and price doesn’t stall near resistance.

If we see a daily close over $190–$191 with volume, the next move likely pushes to $195–$200 fast. However, if the breakout stalls and we fade under $185–$186, this becomes a failed breakout and could unwind toward $170–$175 quickly.

Risk/reward favors waiting for confirmation over guessing.