Rivian Automotive (RIVN) Stock Analysis – July 18, 2025

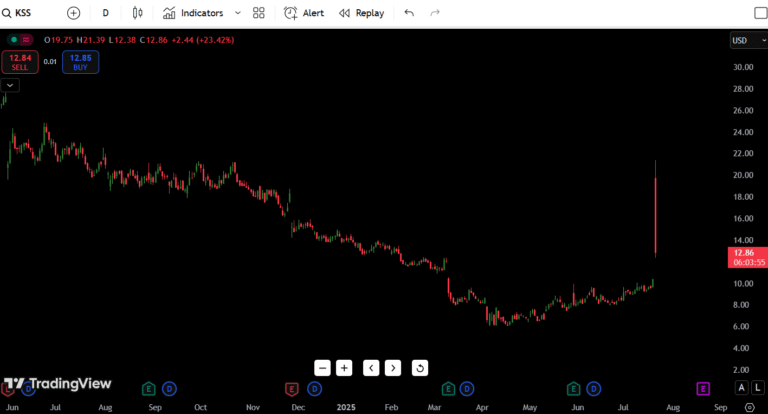

As of July 18, 2025, Rivian Automotive (NASDAQ: RIVN) is trading at $12.90, gaining 4.12% on the day. The price is bouncing near its 52-week low of $11.68, signaling a potential bottoming reversal but confirmation is still pending.

- 52-Week High: $28.06

- 52-Week Low: $11.68

- Today’s Key Support: $12.00

- Immediate Resistance: $13.50

- Bias: Cautiously Bullish

- Chart Signal: Bullish Engulfing Candle at Demand Zone

Contents

- RIVN Candlestick Chart Analysis

- Key Support and Resistance Levels

- 7-Day Price Forecast (Based on Chart Structure)

- Buy, Hold, or Sell?

- Fundamental Triggers to Watch

- Final Thoughts (Trader Perspective)

- FAQ’s

- 1. Is Rivian (RIVN) a good stock to buy today?

- 2. What is Rivian’s (RIVN) stock price forecast for this week?

RIVN Candlestick Chart Analysis

- Macro Trend: Still in a downtrend

- Short-Term Shift: Possible reversal from $12.00 base

- Today’s Candle: Bullish engulfing — strong bounce from $12.00

- Pattern Setup: Potential double bottom or short squeeze base

- Key Observation: Buyers stepped in after a long string of red candles

- Volume (Assumed): Implied strength from bullish follow-through

Key Support and Resistance Levels

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $13.50 | Recent swing high |

| Resistance 2 | $14.20 | Breakout trigger |

| Resistance 3 | $15.50 | Gap-fill zone |

| Resistance 4 | $28.06 | 52-week high |

| Support 1 | $12.00 | Daily demand zone |

| Support 2 | $11.68 | 52-week low |

| Support 3 | $10.90 | Measured downside move |

| Support 4 | $9.50 | Pandemic-era psychological level |

Watch $12.00 — break below opens doors to $11.68 or lower.

7-Day Price Forecast (Based on Chart Structure)

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 19 | $13.20 | $12.50 | $12.95 |

| July 20 | $13.50 | $12.80 | $13.30 |

| July 21 | $13.80 | $13.10 | $13.60 |

| July 22 | $14.00 | $13.40 | $13.80 |

| July 23 | $14.30 | $13.60 | $13.90 |

| July 24 | $14.50 | $13.80 | $14.20 |

| July 25 | $14.75 | $14.00 | $14.50 |

If price stays above $12.00, expect a slow grind to $14.50

If it fails $12.00, expect downside retest of $11.68 or even $10.90

Buy, Hold, or Sell?

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $13.50 | Breakout confirmed with volume |

| HOLD | Range between $12.00–$13.50 | Accumulation zone |

| SELL | Break below $12.00 | Breakdown invalidates setup |

Ideal trade: Long above $13.50 with stop under $12.50

Avoid buying if price stalls near $13.30 without volume

Fundamental Triggers to Watch

- Next Earnings: Early August — can shift momentum

- EV Sector Buzz: Tesla, Ford updates may influence sentiment

- Macro Factors: Fed interest rate moves, inflation data

- Short Interest: High short interest can spark a squeeze

- Production/Margin Updates: Key for long-term investors

Final Thoughts (Trader Perspective)

- Bullish only if $12.00 holds and $13.50 breaks

- Break below $12.00 could dump to new lows

- Targets if breakout happens: $14.50 → $15.50

- Trap Risk: If volume doesn’t follow through, watch for fakeouts

- Stop Loss: Below $11.68 to limit risk

Trader Insight:

“I’ve traded countless EV stocks over the years. What I’m seeing here is a textbook reversal setup — but the market doesn’t care unless volume confirms. Don’t chase green candles. Let price prove itself above $13.50.”

FAQ’s

1. Is Rivian (RIVN) a good stock to buy today?

Rivian is currently showing signs of a potential reversal from its multi-month low near $12.00. A close above the $13.50 resistance with strong volume could trigger a breakout, making it attractive for short-term traders. However, long-term investors should watch for earnings updates and production guidance before entering.

2. What is Rivian’s (RIVN) stock price forecast for this week?

Based on current technical analysis, RIVN could reach a high of $14.50 by the end of this week if it holds above $12.00 support. Failure to stay above that level could send it back toward the $11.68 52-week low. A breakout above $13.50 would shift short-term momentum bullish.

{ “@context”: “https://schema.org”, “@type”: “NewsArticle”, “headline”: “RIVN Stock Breaks Key Resistance – What’s Next?”, “datePublished”: “2025-07-18T08:00:00+00:00”, “author”: { “@type”: “Person”, “name”: “Sam Adam” }, “publisher”: { “@type”: “Organization”, “name”: “Brndups Stock Insights”, “logo”: { “@type”: “ImageObject”, “url”: “https://brndups.com/wp-content/uploads/2023/05/brndupslogo.png” } } }