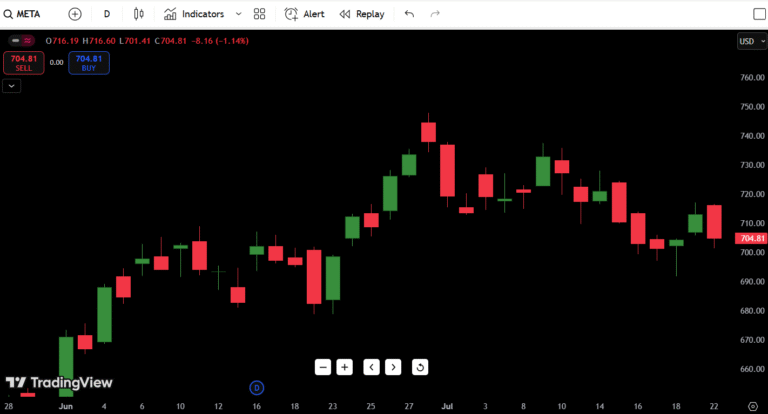

META (META) Stock Analysis – July 22, 2025

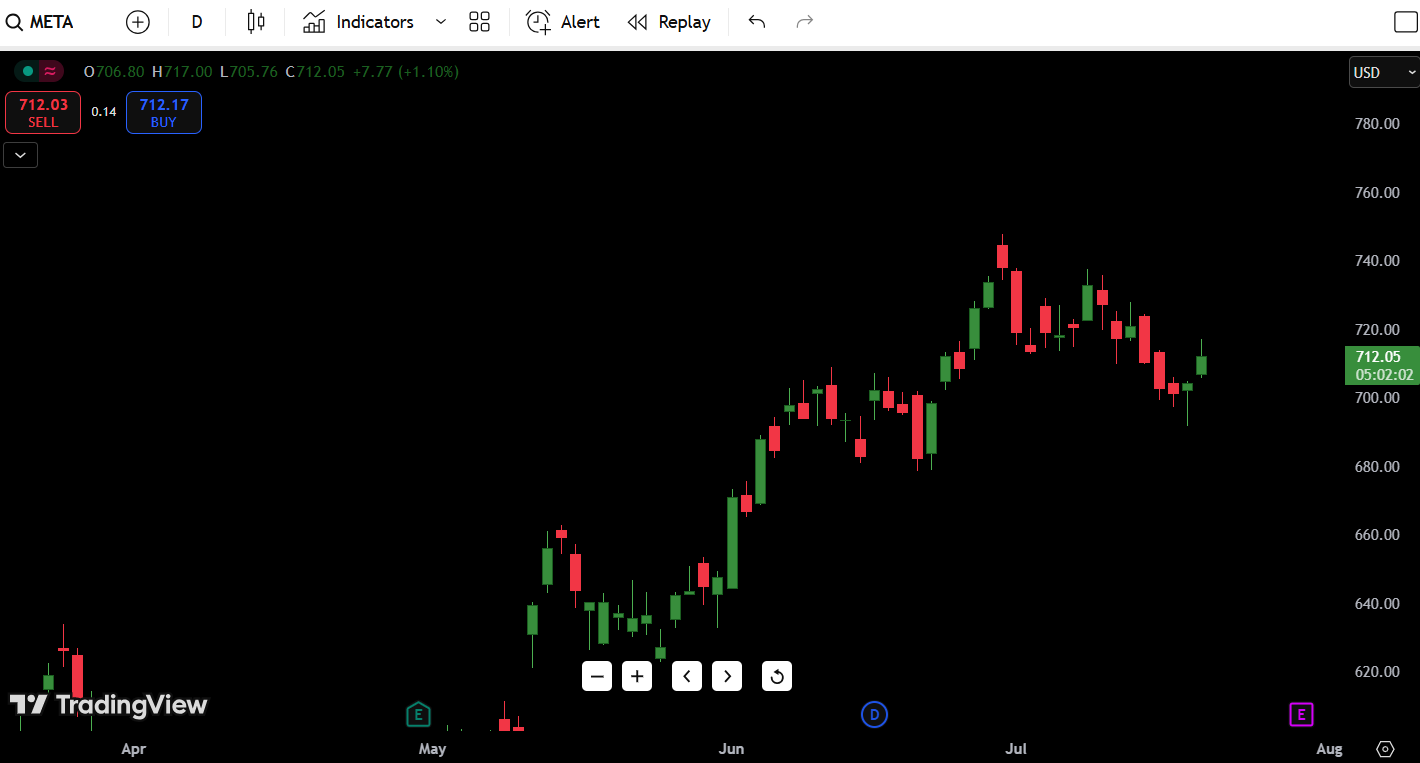

META Platforms Inc. (META) is showing early signs of a potential rebound after a brutal multi-week pullback from its June highs. As of today, META stock is trading at $712.05, up +1.10% for the session. After briefly dipping below $700 support last week, bulls stepped in aggressively, pushing the stock back above key short-term levels.

- Current Price: $712.05

- Daily Direction: Bullish reversal attempt

- 52-Week High: $780.00

- 52-Week Low: $580.00

- Key Support: $700 / $685

- Key Resistance: $720 / $740

Contents

- Observation for July 22:

- Candlestick Chart Analysis for July 22 Outlook

- Trend Overview:

- Recent Candlestick Behavior:

- Market Structure:

- Volume Profile (Visual Assessment):

- Support and Resistance Levels Table

- META 7-Day Price Forecast Table (July 22 Start)

- Forecast Logic:

- Buy, Hold, or Sell Decision Table

- Current Bias:

- Fundamental Triggers

- Upcoming Events Impacting META Stock Forecast:

- Final Thoughts for July 22, 2025

- Outlook: Neutral to Slightly Bullish (Contingent on $720 Break)

- Critical Zones to Watch:

- My Trading Insight (Trader’s Perspective):

Observation for July 22:

META is attempting to reclaim short-term bullish structure after finding support near $700. However, this bounce remains fragile unless bulls can reclaim $720+ with conviction. Otherwise, this move risks fading back into recent lows.

Candlestick Chart Analysis for July 22 Outlook

Trend Overview:

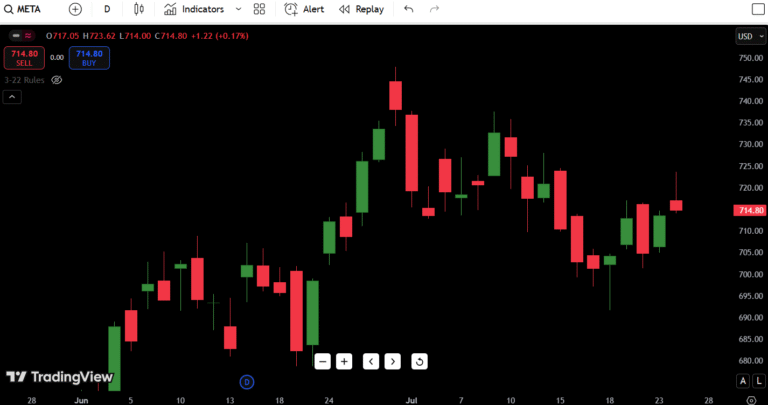

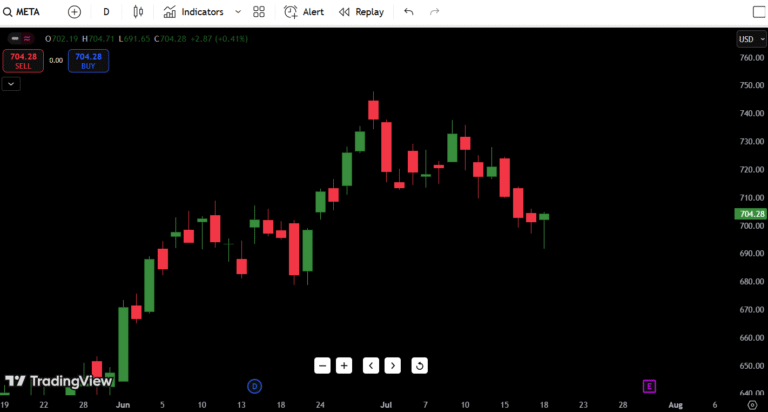

META had been enjoying a strong uptrend from late April through June, carving higher highs and higher lows. However, the sharp pullback from $750 down to $700 disrupted momentum. The current action is an early-stage potential reversal or dead cat bounce.

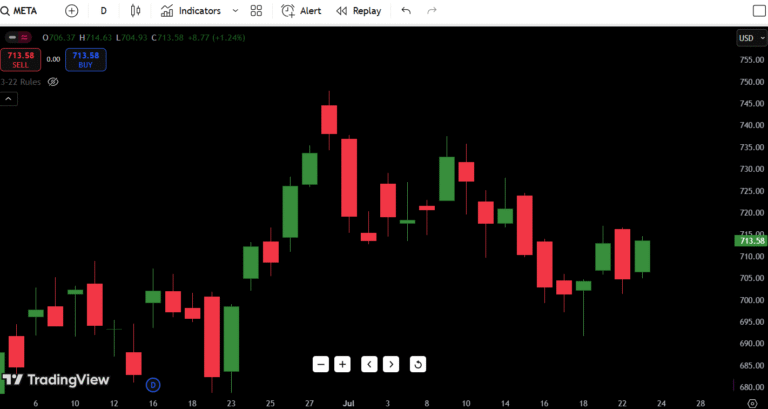

Recent Candlestick Behavior:

- Strong green candle today reclaiming $710+ zone after last week’s weakness.

- The prior candles show hammer-like rejection wicks below $700, indicating demand.

- This week’s action resembles a possible bullish reversal attempt off demand.

Market Structure:

- Short-Term: Attempting to flip from bearish pullback to bullish recovery.

- Medium-Term: Neutral until we see acceptance back above $720–$740.

- Critical Zone: $700–$720 dictates next leg; failure = revisit $680s.

Volume Profile (Visual Assessment):

- Decent volume on today’s green candle but still lower than peak sell days.

- Volume confirmation will be key if bulls aim for $740 again.

Summary: META is at a crossroads between a genuine rebound and a relief rally. Bulls need to defend $700 and push through $720+ this week to regain confidence.

Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $720.00 | Nearest swing resistance |

| Resistance 2 | $740.00 | Breakdown origin / minor supply |

| Resistance 3 | $750.00 | Recent swing high |

| Resistance 4 | $780.00 | 52-week high |

| Support 1 | $700.00 | Key psychological support |

| Support 2 | $685.00 | Recent demand zone |

| Support 3 | $660.00 | Breakdown risk zone |

| Support 4 | $580.00 | 52-week low |

Key Level: $700 needs to hold, $720 needs to break for bullish continuation.

META 7-Day Price Forecast Table (July 22 Start)

| Date | High | Low | Expected Close |

|---|---|---|---|

| July 22 | $720 | $705 | $712 |

| July 23 | $725 | $710 | $718 |

| July 24 | $740 | $715 | $735 |

| July 25 | $745 | $730 | $740 |

| July 26 | $740 | $715 | $728 |

| July 27 | $730 | $700 | $710 |

| July 28 | $715 | $685 | $700 |

Forecast Logic:

If META holds $705–$710 and pushes through $720+ this week, we likely see a test of $735–$740. Failure at $720 likely brings another test of $700 or even $685. Volume confirmation is crucial for trust in any upside breakout.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $720 | Structure reclaim confirmed |

| HOLD | Range-bound $700–$720 | Rebuilding base, no clear breakout |

| SELL | Break below $700 | Rejection of bounce, back to lows |

Current Bias:

Cautious hold. The bounce off $700 is encouraging but needs confirmation. Buyers should wait for a daily close above $720 with volume to add confidently. Below $700? The risk of continued selling increases toward $685–$660.

Fundamental Triggers

Upcoming Events Impacting META Stock Forecast:

- Earnings Report: META’s earnings are on deck in early August—any forward guidance on AI, ad revenue, or Reels engagement will heavily influence sentiment.

- Sector Sentiment: Social media peers (GOOG, SNAP) earnings and ad-spend trends could impact META.

- Regulatory Risks: Ongoing scrutiny over data privacy, AI usage, and advertising ethics.

- Macro Factors: Any surprise from the Fed on rate policy or recession warnings would likely pressure high-beta tech like META.

- Analyst Revisions: Re-ratings up or down post-earnings could swing momentum sharply.

Final Thoughts for July 22, 2025

Outlook: Neutral to Slightly Bullish (Contingent on $720 Break)

META’s recent pullback appears technically healthy so far—a normal digestion phase after a big run. However, we are still in a fragile technical zone between $700–$720. This is not yet a confirmed reversal, but early signs are constructive.

Critical Zones to Watch:

- Breakout Reclaim Zone: $720+

- Must-Hold Support: $700

- Failure Risk Zone: $685–$660

My Trading Insight (Trader’s Perspective):

In my experience, after sharp pullbacks like this, stocks either break out fast from reclaim zones ($720+) or they fail back into lows swiftly. META is showing early promise—but until volume drives us over $720+, this could still be a bear trap bounce.

If META closes strong over $720–$725, I’d expect a push to $740+ this week. If we roll over under $700 again? Risk opens to a deeper retrace into the mid-$600s.

Patience matters here—let price confirm.