Meta Platforms (META) Stock Analysis – July 23, 2025

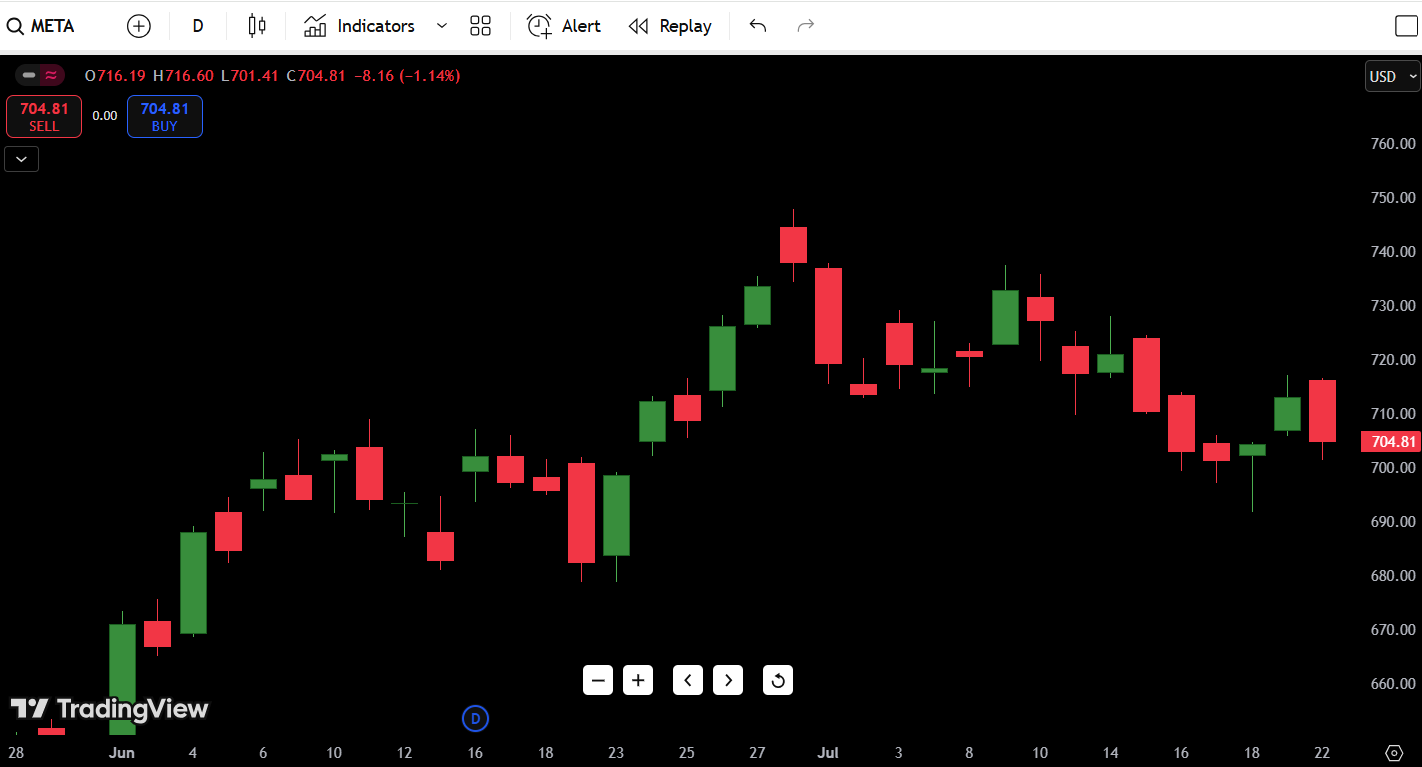

As of July 23, Meta Platforms (META) is trading at $704.81, down 1.14% on the day. The stock has been steadily pulling back from a recent high of $740.00 and now sits near a key short-term support zone between $700 and $710.

- Meta stock price on July 23: $704.81

- META Stock Forecast Today: Cautious bearish bias unless support holds

- Daily Direction: Bearish

- 52-Week High: $787.65

- 52-Week Low: $285.32

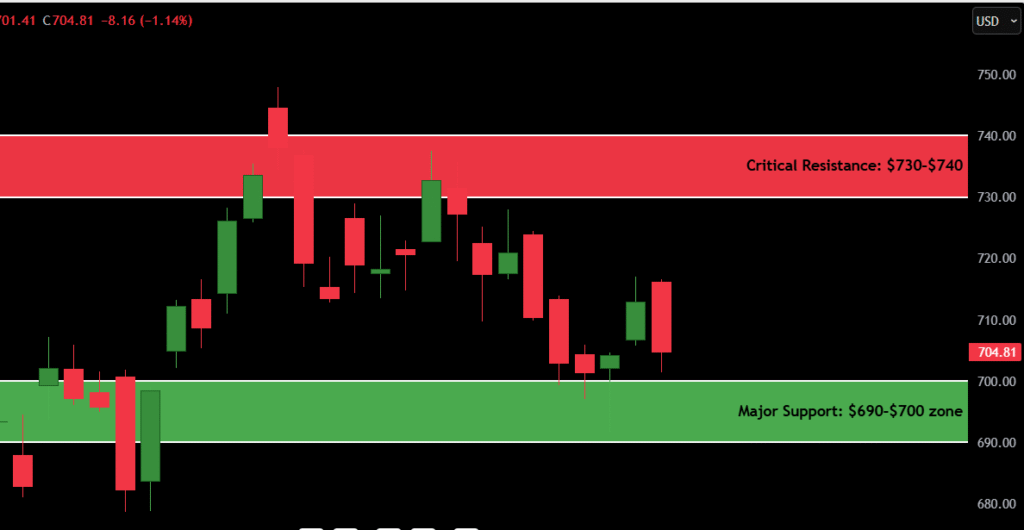

- Critical Resistance: $730–$740

- Major Support: $690–$700 zone

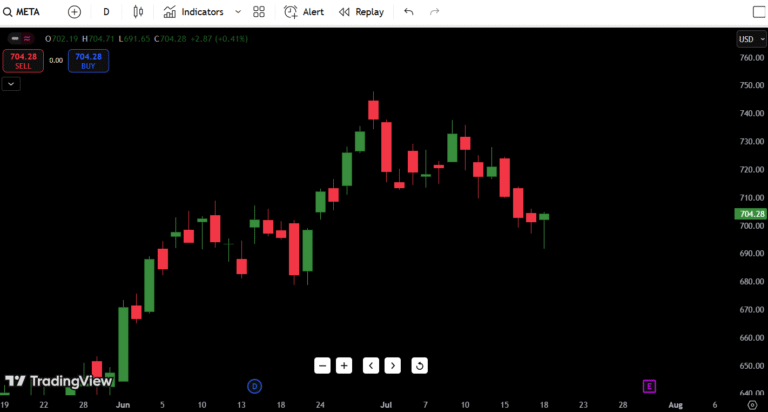

META’s candlestick chart today shows clear weakness. After several failed attempts to break higher, buyers are starting to lose control — and short-term bears are beginning to test the waters again.

Contents

Candlestick Chart Analysis: META Price Action Today

The META candlestick chart as of July 23 paints a clear picture of exhaustion and weakness:

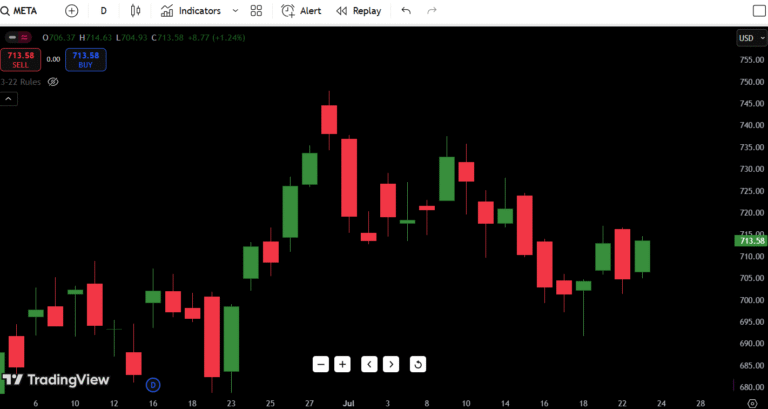

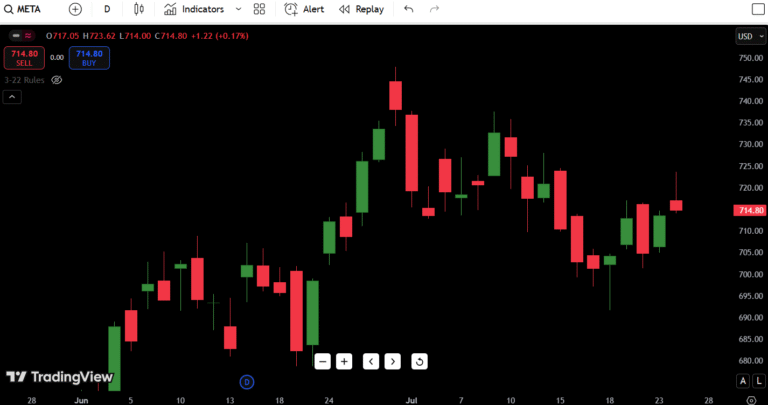

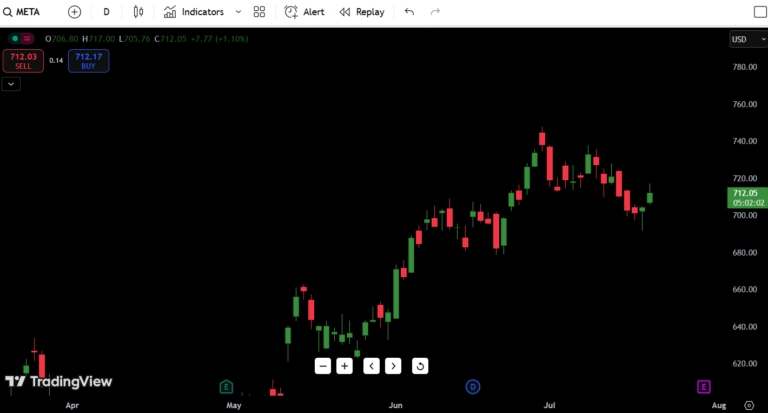

- Trend: META is in a near-term downtrend, with lower highs forming after peaking at ~$740 in early July.

- Pattern: Today’s candle is a large-bodied red bar closing near the day’s low — classic bearish continuation. This follows a series of indecisive candles and failed bullish pushes.

- Volume: While volume isn’t shown in this snapshot, the size and structure of the candle imply seller strength and a possible uptick in bearish momentum.

- Structure: The chart shows a failed retest of $720, followed by steady selling. Recent attempts to bounce off $700 have been weak and short-lived.

This isn’t a crash — it’s a controlled pullback. But if META breaks below $700 with conviction, the next leg lower toward $680 or even $660 could accelerate quickly.

META Support and Resistance Levels Table

| Type | Price Level | Description |

|---|---|---|

| Resistance 1 | $715 | Minor supply area from July 22 |

| Resistance 2 | $730 | Lower high and failed breakout zone |

| Resistance 3 | $740 | Recent swing high |

| Resistance 4 | $765 | Previous gap-fill and trendline |

| Support 1 | $700 | Psychological + recent bounce |

| Support 2 | $690 | Pre-breakout base from June |

| Support 3 | $660 | Breakdown target |

| Support 4 | $620 | 50% retracement of 2024–2025 move |

Key level to watch: $700. A daily close below it flips the script short-term.

META 7-Day Price Forecast

| Date | High | Low | Expected Close |

|---|---|---|---|

| Day 1 (7/24) | $710 | $695 | $702 |

| Day 2 (7/25) | $708 | $690 | $695 |

| Day 3 (7/26) | $700 | $685 | $692 |

| Day 4 (7/27) | $705 | $690 | $699 |

| Day 5 (7/28) | $715 | $695 | $710 |

| Day 6 (7/29) | $720 | $705 | $718 |

| Day 7 (7/30) | $728 | $710 | $725 |

Forecast logic:

If META can defend the $690–$700 support zone, it may attempt a slow climb back toward $720+. However, if it breaks down below $690, the stock could spiral into a bearish acceleration toward $660 support, especially if broader tech weakens.

Buy, Hold, or Sell Decision Table

| Action | Trigger Condition | Reasoning |

|---|---|---|

| BUY | Close above $730 | Breakout above lower high confirms strength |

| HOLD | Range between $690–$715 | Sideways chop – wait for confirmation |

| SELL | Break below $690 | Breakdown from structure + fresh lows |

Trading Decision Breakdown:

For now, META is a hold or light sell into bounces unless it reclaims $730. The $700–$690 zone has acted as a magnet for price, and bulls have failed to push back convincingly. If the market remains weak or tech underperforms, short setups below $690 become attractive with a first target around $660.

Fundamental Triggers to Watch

These macro and company-specific catalysts could impact META’s next big move:

- Upcoming Earnings: Meta is expected to report Q2 earnings on July 31 – major volatility event

- Advertising Revenue Trends: Meta’s ad business is highly cyclical and sensitive to macro slowdowns

- AI Expansion News: Any updates about LLaMA or AI monetization could reignite bullish sentiment

- Market-wide Tech Rotation: If tech continues to lag after the recent AI hype, META could follow NVDA and TSLA into deeper pullbacks

- Interest Rate Sentiment: Watch for commentary from Fed speakers, as higher rates could hit growth stocks

Final Thoughts: META Buy or Sell Today?

Outlook: Slightly bearish near-term, but cautiously optimistic if support holds.

- If META holds above $700 and earnings deliver, bulls may reclaim $730+ and aim for a fresh attempt toward $740–$750.

- If it fails to hold $690, sellers could target the $660 zone, which aligns with a previous liquidity pocket and fib retracement.

- This isn’t a high-conviction breakout yet — and the chart suggests a pause or pullback, not immediate momentum.

My insight as a trader:

“I’ve seen this setup dozens of times — it looks like a cooling-off phase after a parabolic leg. Unless META snaps back above $715–$720 quickly, I’ll avoid going long until we retest either $690 or $660 with strong reversal candles.”